Fabulous Info About What Is The Trendline Trading Strategy How To Change Scale Of Axis In Excel

Or if you prefer, you can watch this training below….

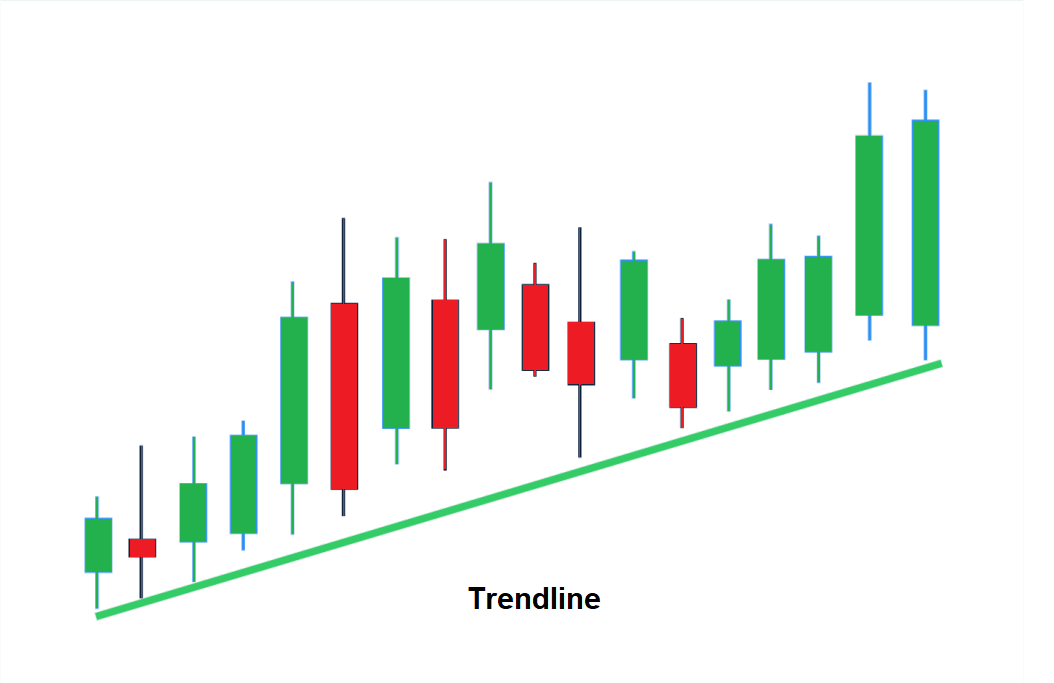

What is the trendline trading strategy. The trend line breakout strategy. Find out how to use the best trendline trading strategy for your style. A trendline trading strategy is a way of trading that relies on the use of trendlines.

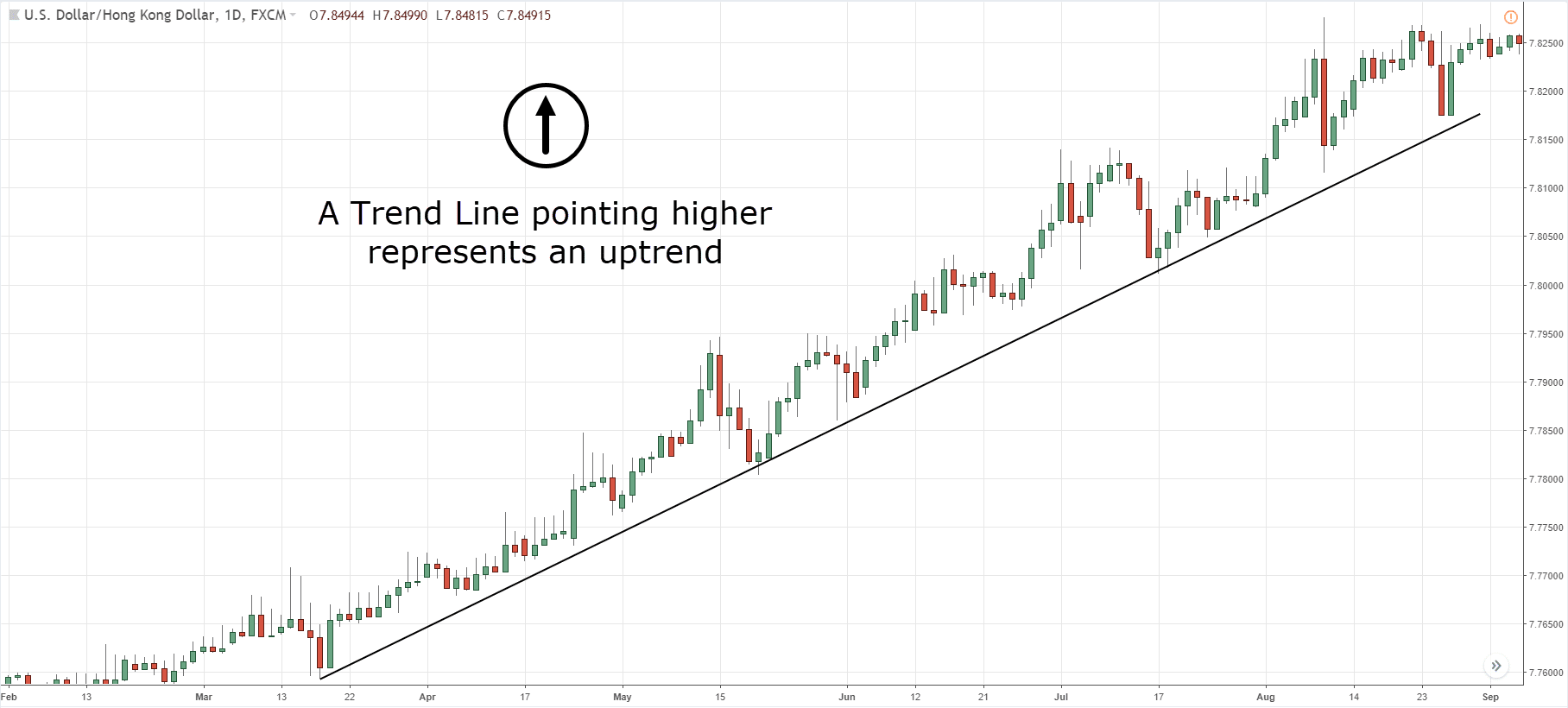

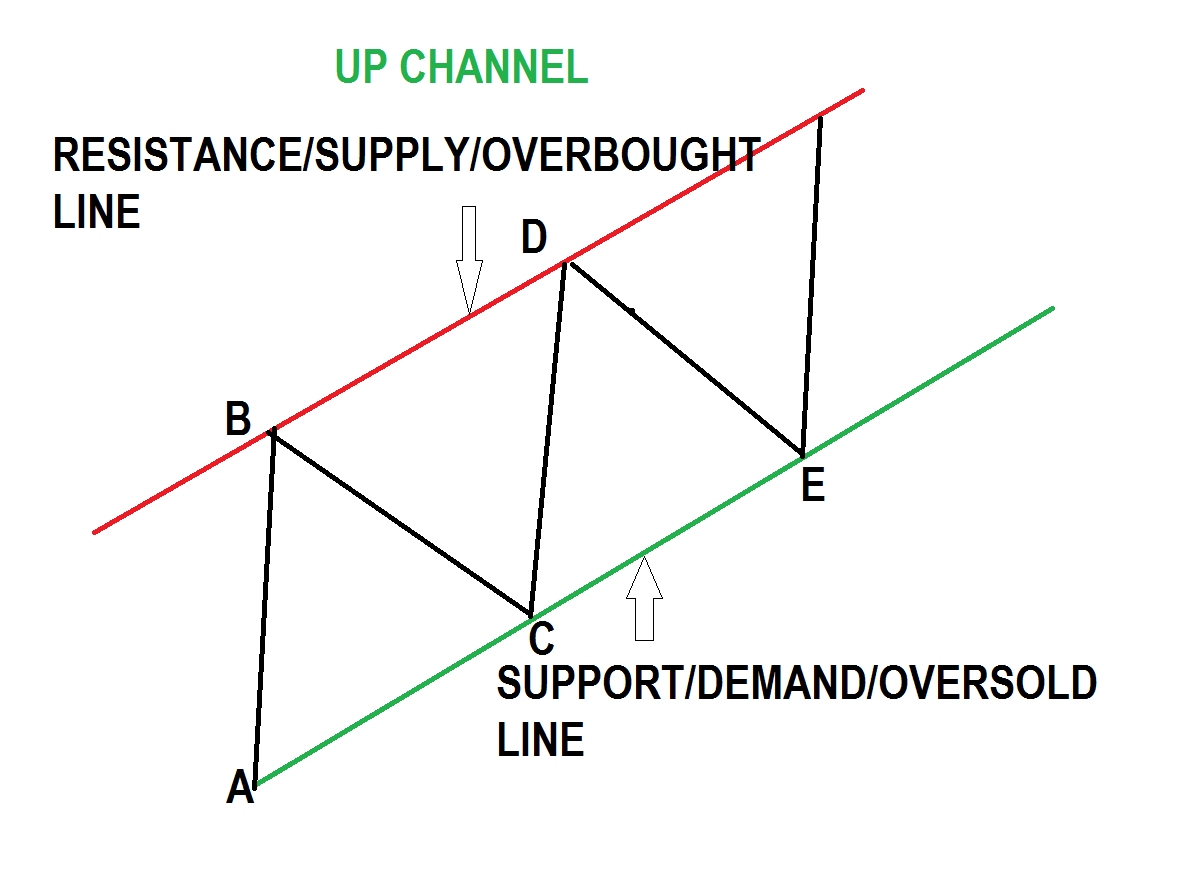

The first step is to identify the trend in the price chart. These lines track the price movement in an attempt to provide traders with a rough idea of how high or low the price may go in a given timeframe. Trend lines can be used to identify and confirm trends.

Boeing ( ba) stock will be on investors' radars. The ability to identify and draw trendlines is one of the most useful tools in technical analysis. Trend trading, also known as trend following, is a trading strategy that forms the bedrock of many successful traders’ portfolios.

The boeing share price may find resistance from the broadening formation's upper trendline at $290 and support near its lower trendline at $160. Lines with a positive slope that support price action show that net. The trendline trading strategy allows traders to consider market direction over timeframes to see how long price momentum might hold up.

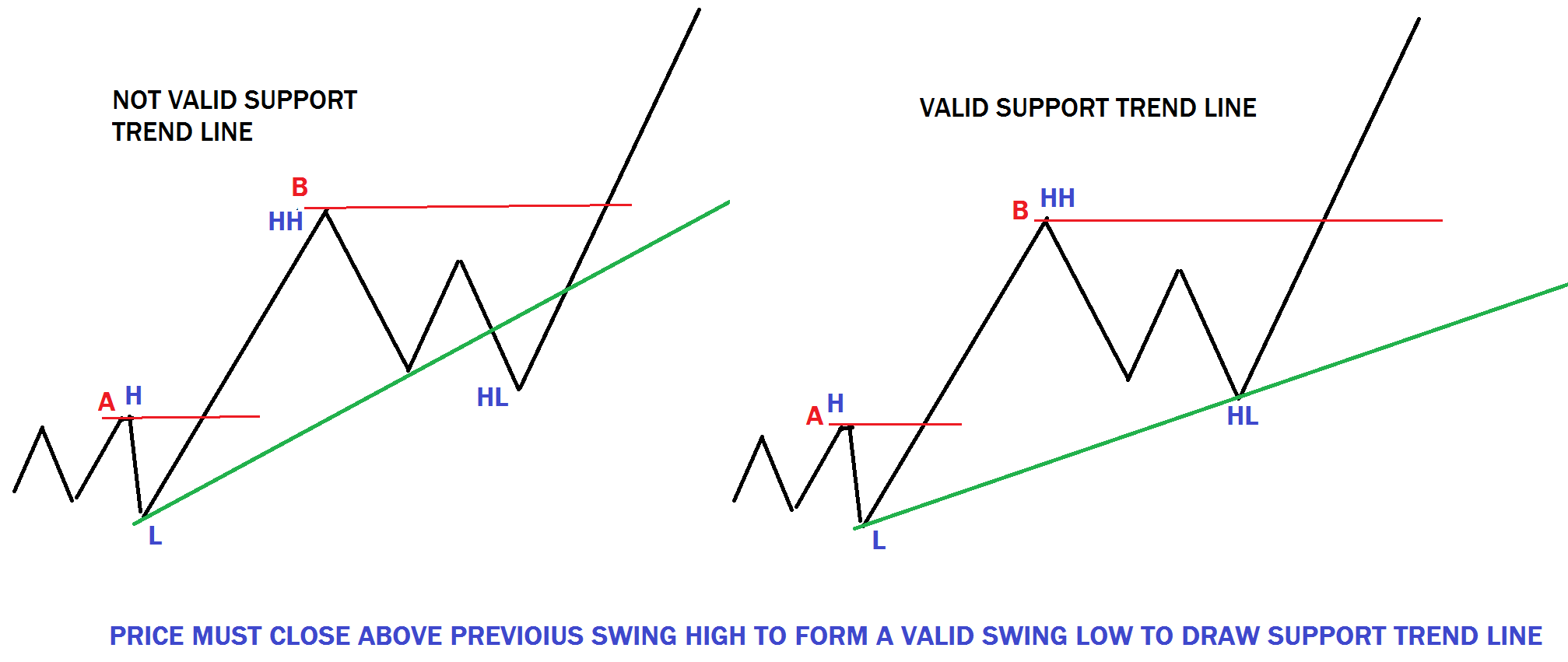

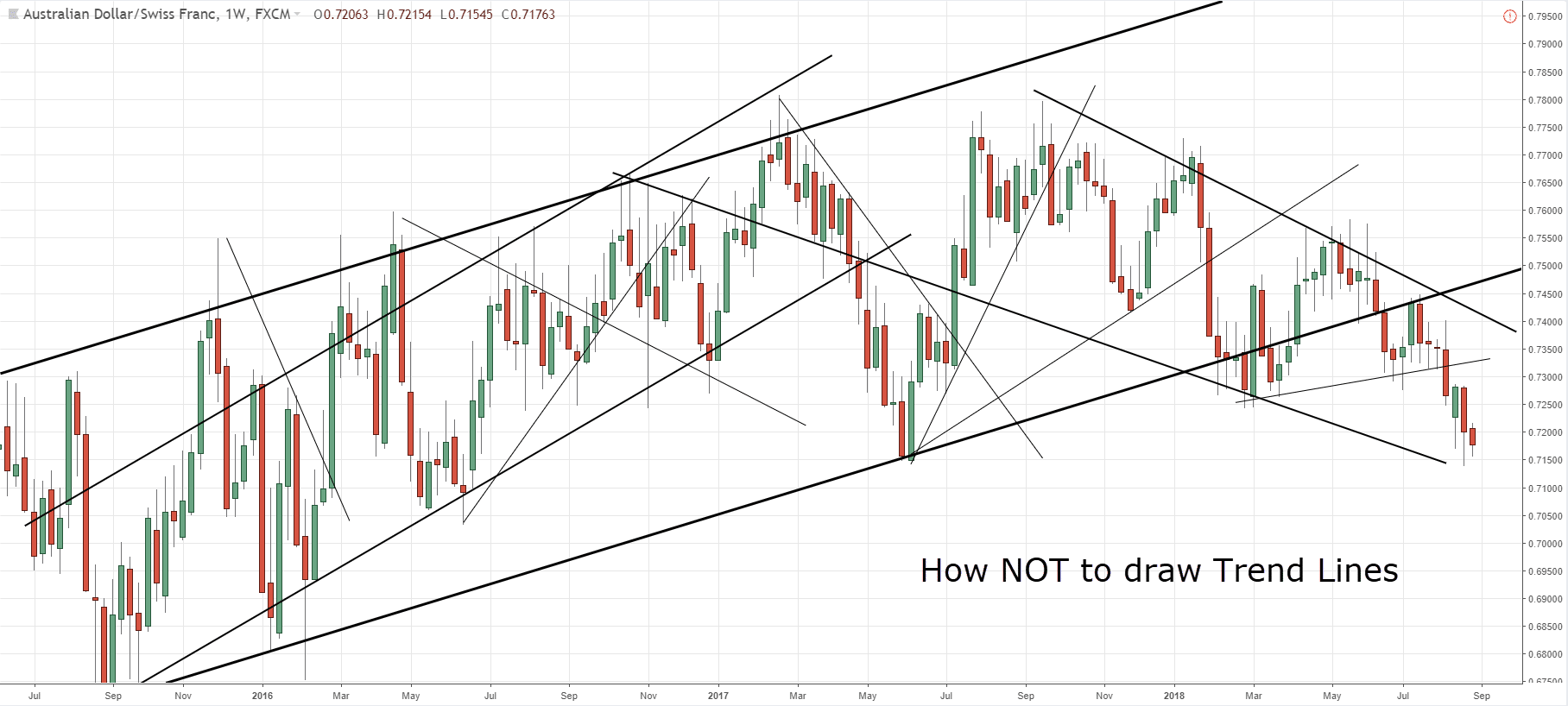

Trendlines are straight lines connecting key price levels to visualize the direction of the price trend. Trend line trading is a valuable skill for traders looking to analyze and capitalize on market trends. Pay attention to price action, and always consider it when using trendlines.

If the price makes lower lows and lower highs, it's still a downtrend—even if the price moves above a descending trendline. Trendlines visually represent support and resistance in any timeframe by showing direction, pattern and price contraction. The resulting line is then used to give the trader a good.

They show direction and speed of price, and also describe patterns during periods of price. They also provide insights into whether an asset is a buy or sell at a specific price, and whether a trader should choose to. A trendline can be a valuable technical analysis tool for developing trading strategies.

This is drawn by connecting the low points of an asset's price over time. While the manufacturing read came in line with expectations at 49.5, its second straight month. A trendline is a straight line drawn on a trading chart that connects two or more price points.

Trendlines are used to visually gauge support and resistance price levels and the trend, whether it is up, flat, or down. Trendlines are used to determine whether an asset is in a form of uptrend or downtrend. A price chart showing higher highs and higher lows indicates an uptrend and a price chart showing lower highs and lower lows indicates a downtrend.

It helps to visually represent the direction of the market trend. The ability to identify and draw trendlines is one of the most useful tools in technical analysis. They can be horizontal or diagonal and are usually viewed from left to right on a price chart.