Outrageous Tips About Why Use Garch Instead Of Arch Excel Multiple Time Series Chart

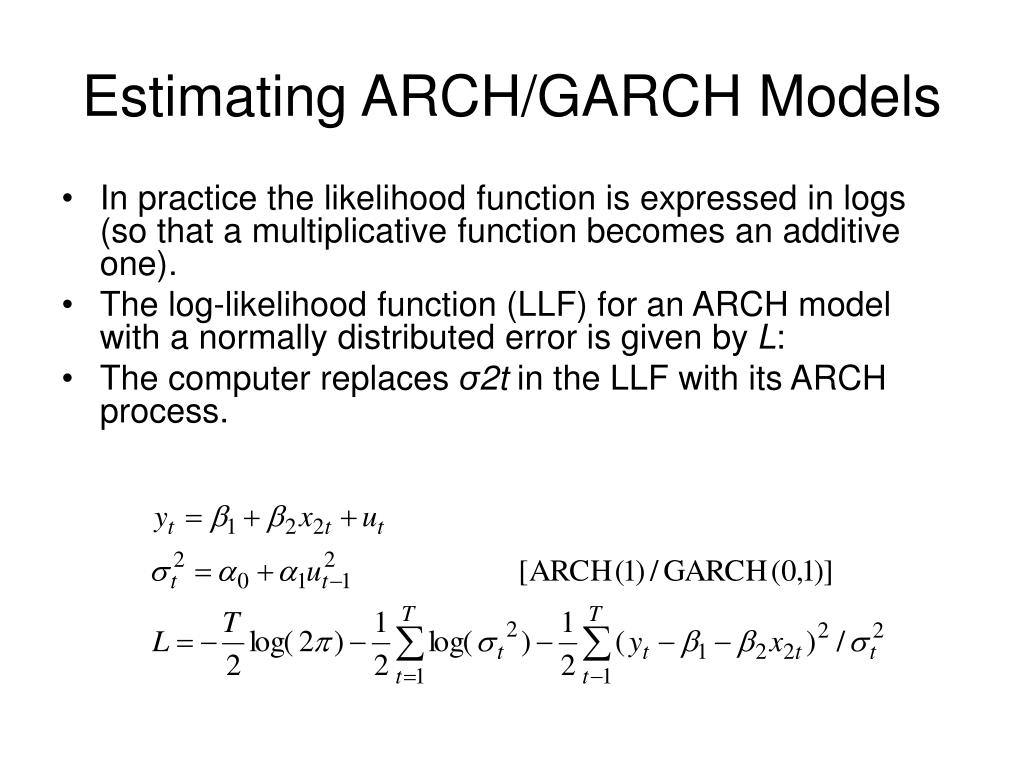

The arch_model() function can specify a garch instead of arch model vol=’garch’ as.

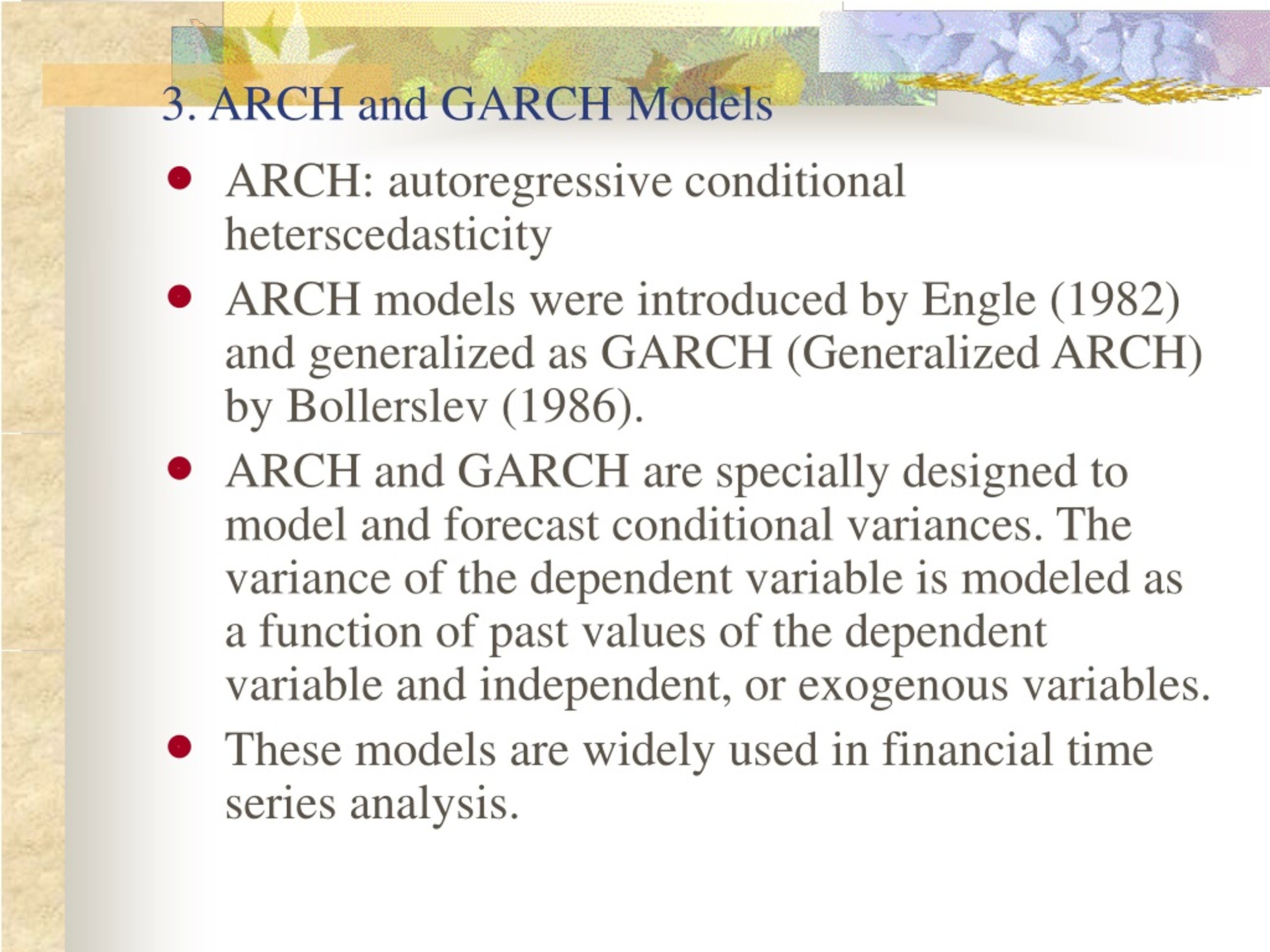

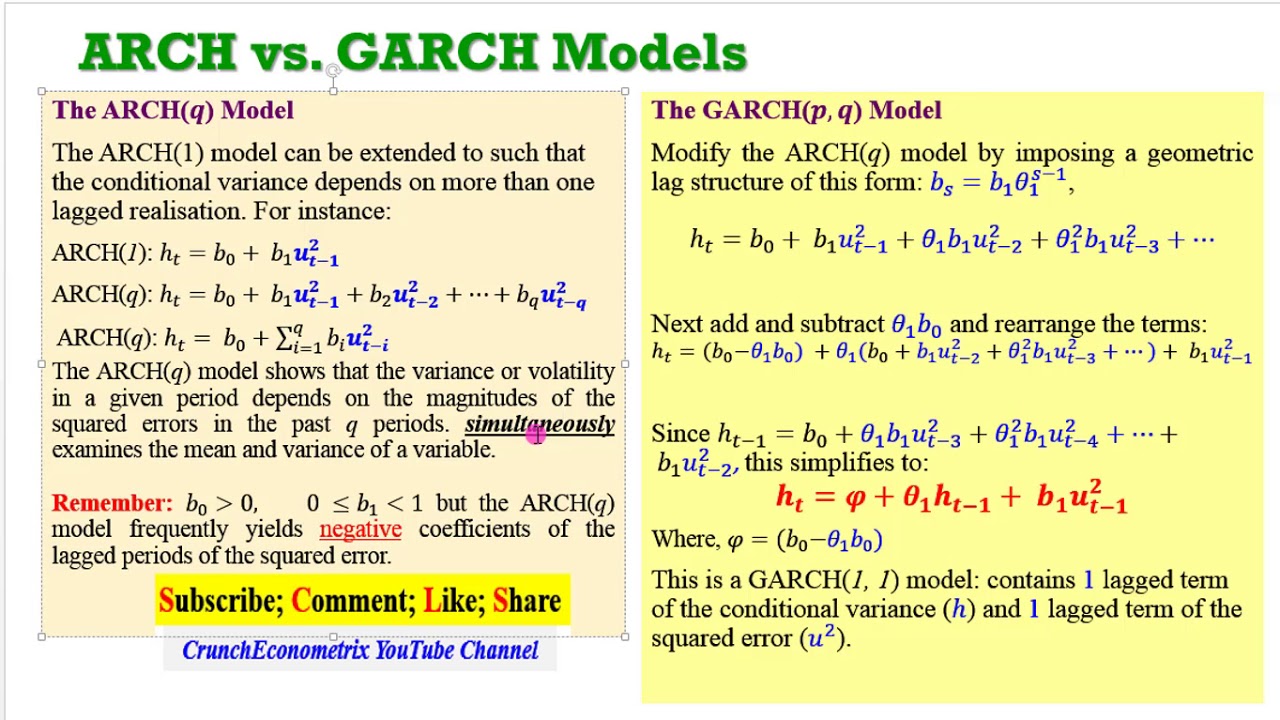

Why use garch instead of arch. These models are especially useful. Arch models are a popular class of volatility models that use observed values of returns or residuals as volatility shocks. What is the difference between garch and arch models?

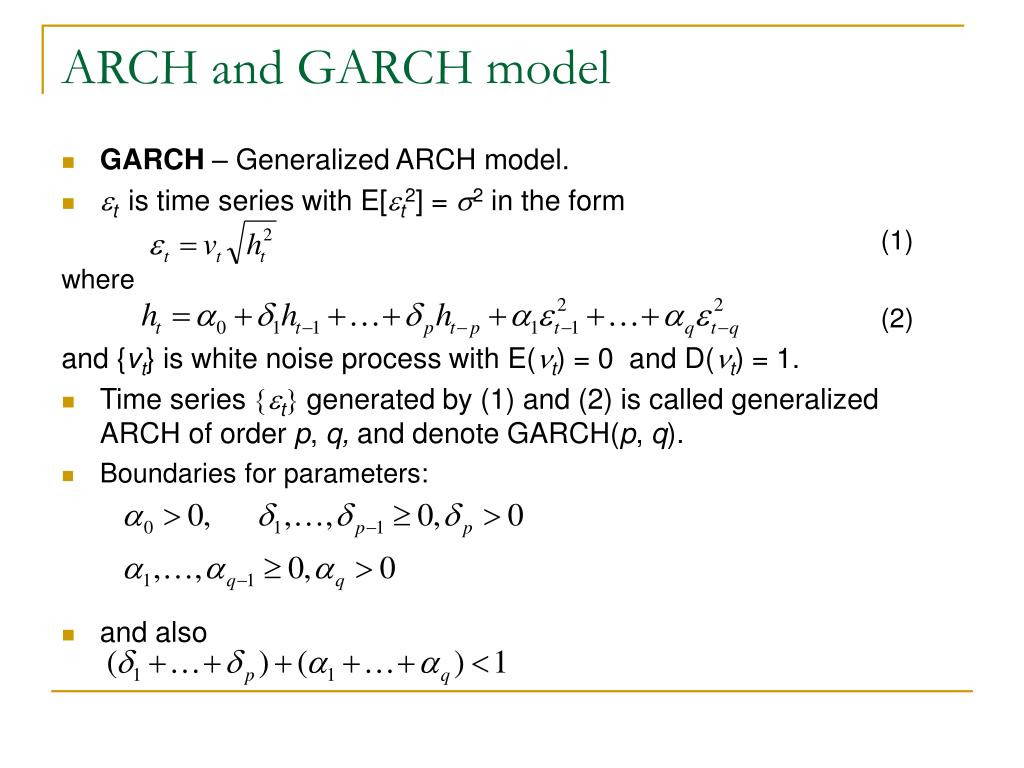

The garch updating formula takes the weighted average of the unconditional variance, the squared residual for the first observation and the starting variance and estimates. Making of the garch model. The reason why garch is useful is because it may better explain the volatility of certain series, particularly in finance.

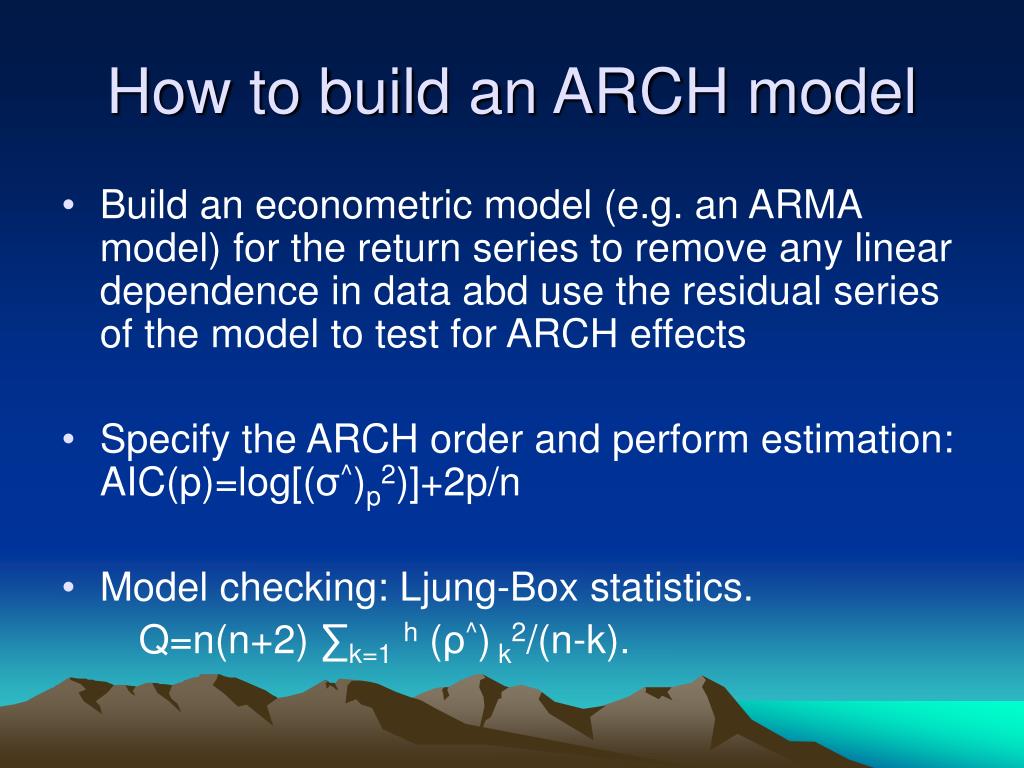

We fit models and built forecasts that could be done on a rolling basis. To illustrate, consider the simple arch (q) model in 2, i.e., σ. Introduction to arch & garch models.

For instance, look at the graph below. This paper gives the motivation behind the simplest garch model and illustrates its usefulness in examining portfolio risk. Garch processes are widely used in finance due to their effectiveness in modeling asset returns and inflation.

You typically want to model the. Autoregressive conditional heteroskedasticity (arch) and its generalized version (garch) constitute useful tools to model such time series. Modified 6 years, 10 months ago.

Engle (2001) claims that the use of garch (generalized arch) models are more efficient than arch models for large series of numbers. Asked 6 years, 10 months ago. The specification is one on conditional standard deviation instead of conditional variance:

It gave us tools in the eda phase to recognize when to use the arch and garch models. Garch is the “arma equivalent” of arch, which only has an. R t = μ + ϵ t ϵ t = σ t.

These data exist back to the 1800s, so arch is great for looking at. How to choose between egarch and garch? Arch and garch models have become important tools in the analysis of time series data, particularly in financial.

A basic garch model is specified as. Six alternative garch models are considered, all of them being of order (1,1): The threshold garch (tgarch) model by zakoian (1994) is similar to gjr garch.

As i understand the inclusion of the garch term, $\sigma^2$, in a garch model allows for an infinite number of time series terms, $\epsilon^2$, to influence the. We can fit a garch model just as easily using the arch library. Trying to recall the birth of the garch model, it must have been sometime in late fall 1984 or winter 1985, when i was a.

:max_bytes(150000):strip_icc()/GARCH-9d737ade97834e6a92ebeae3b5543f22.png)