Fun Info About Is Garch A Time Series Model How To Edit Excel Graph Axis

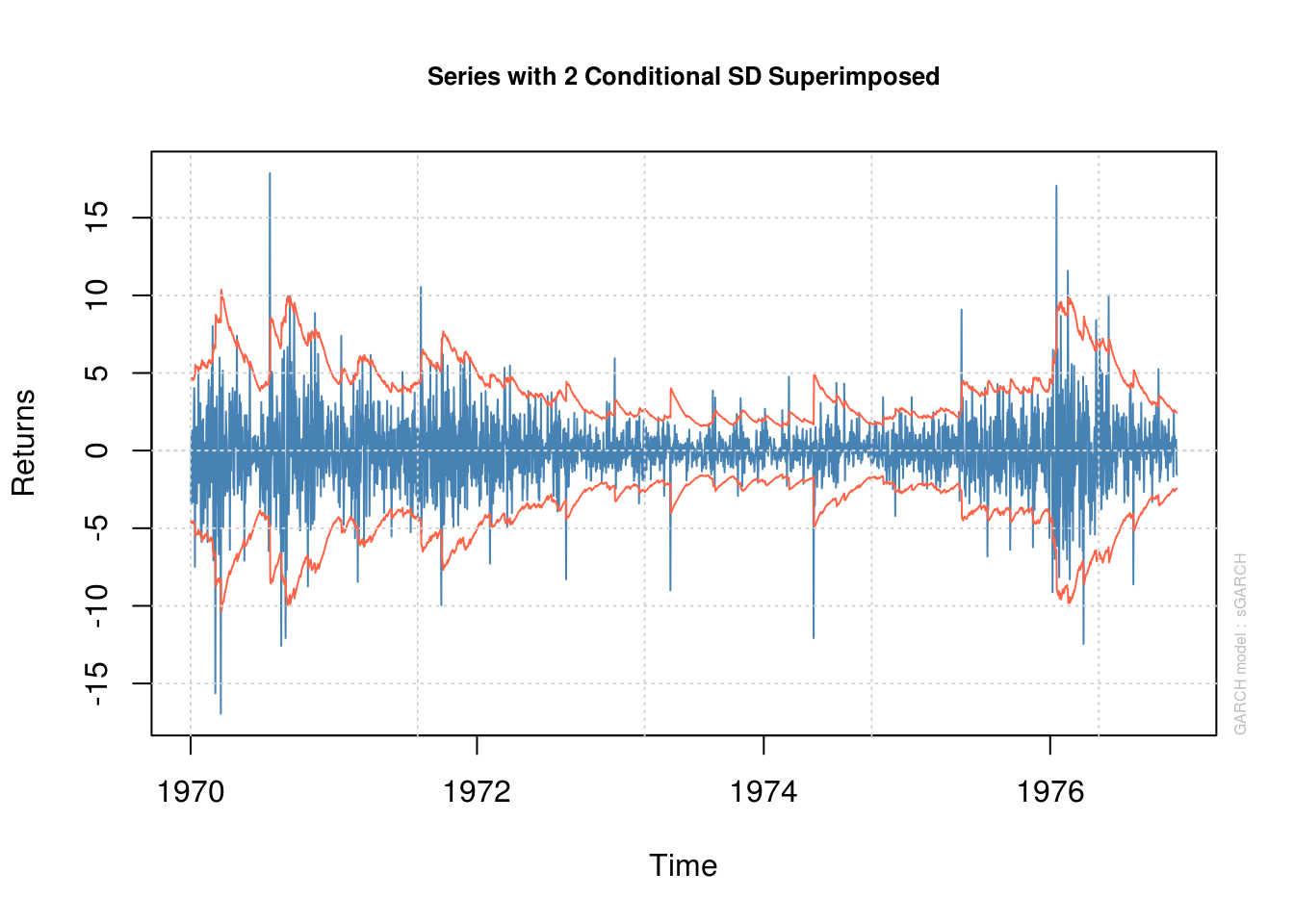

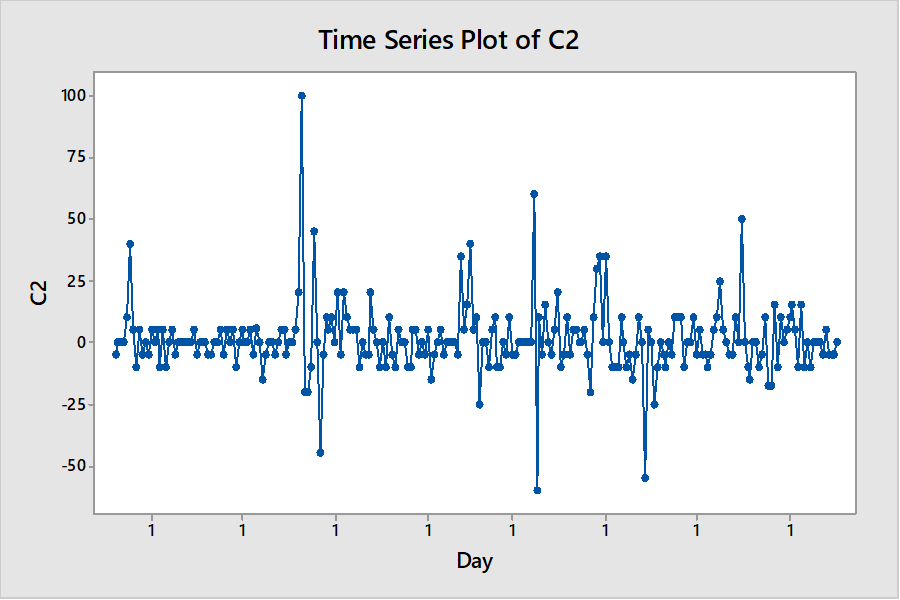

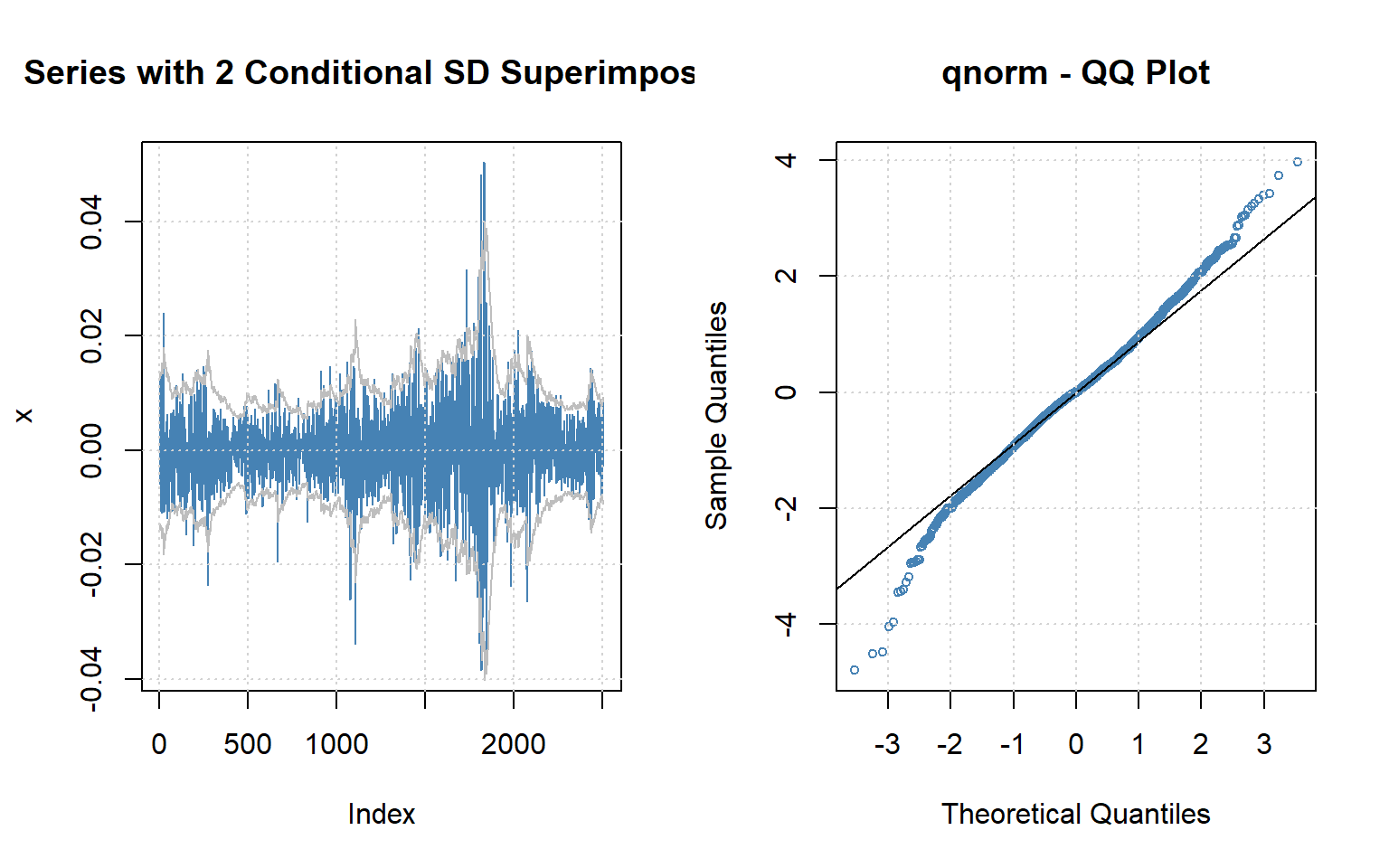

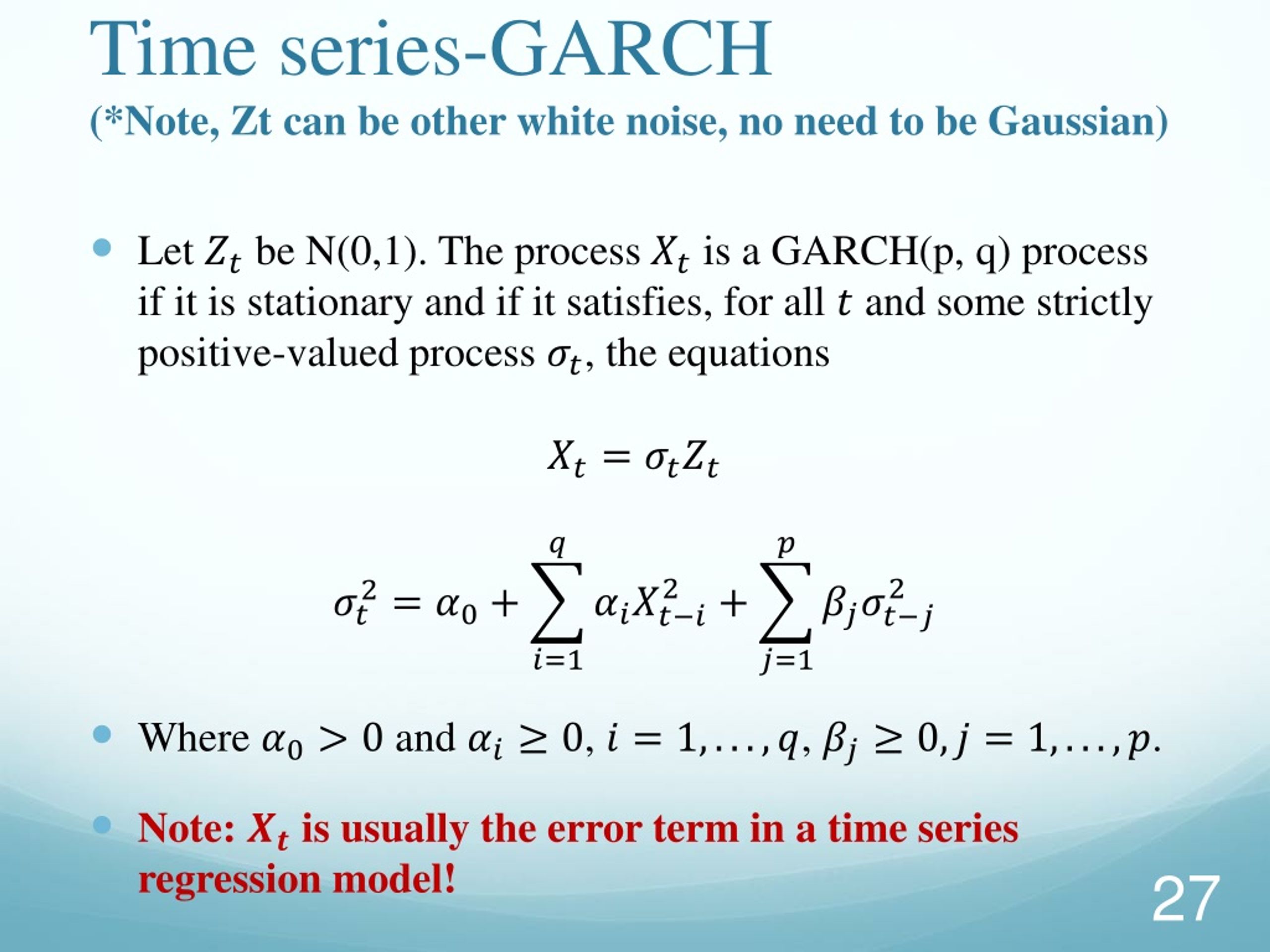

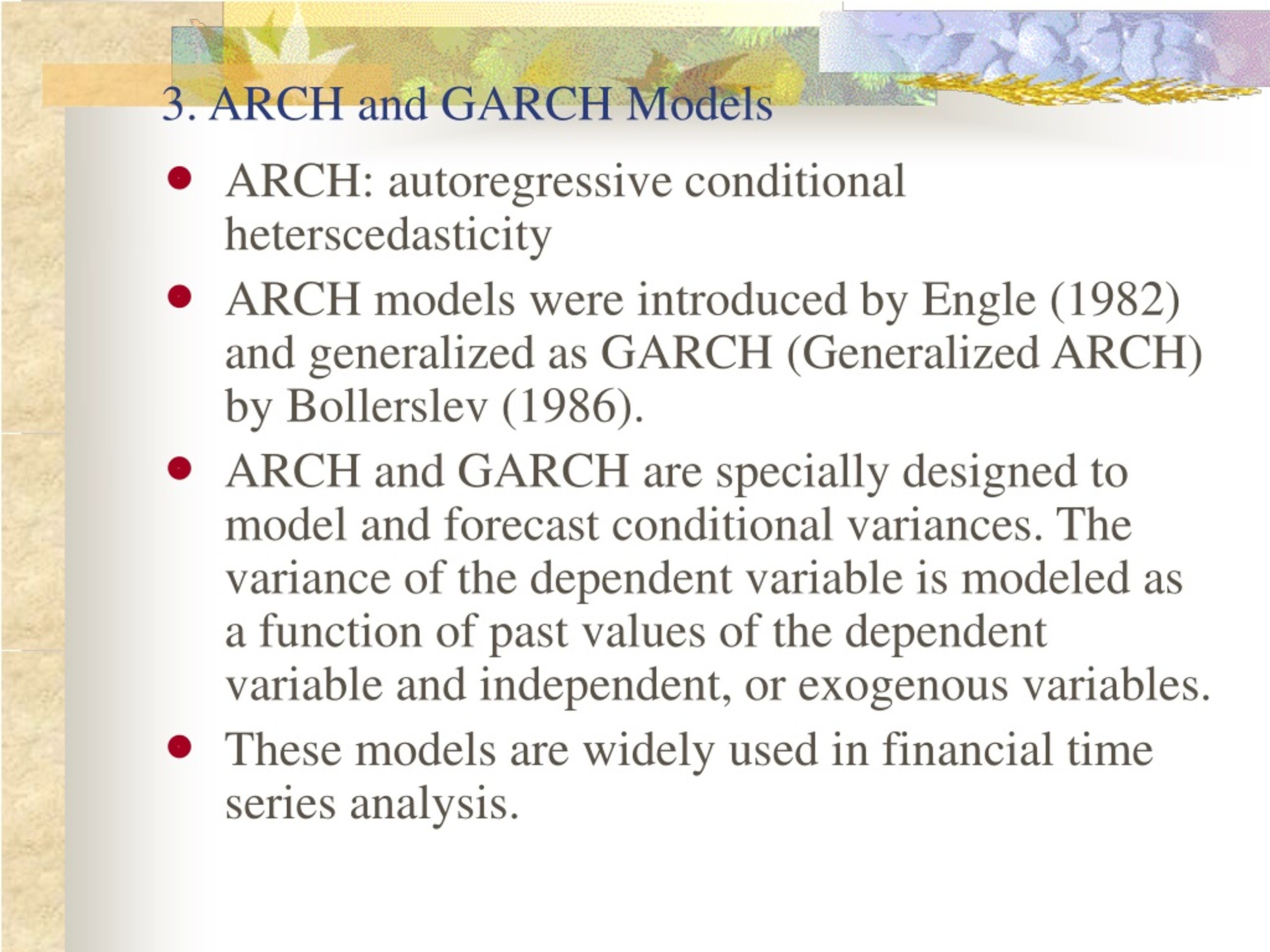

Generalized autoregressive conditional heteroskedasticity (garch) models are a class of time series models that aim to capture the volatility clustering and persistence observed in.

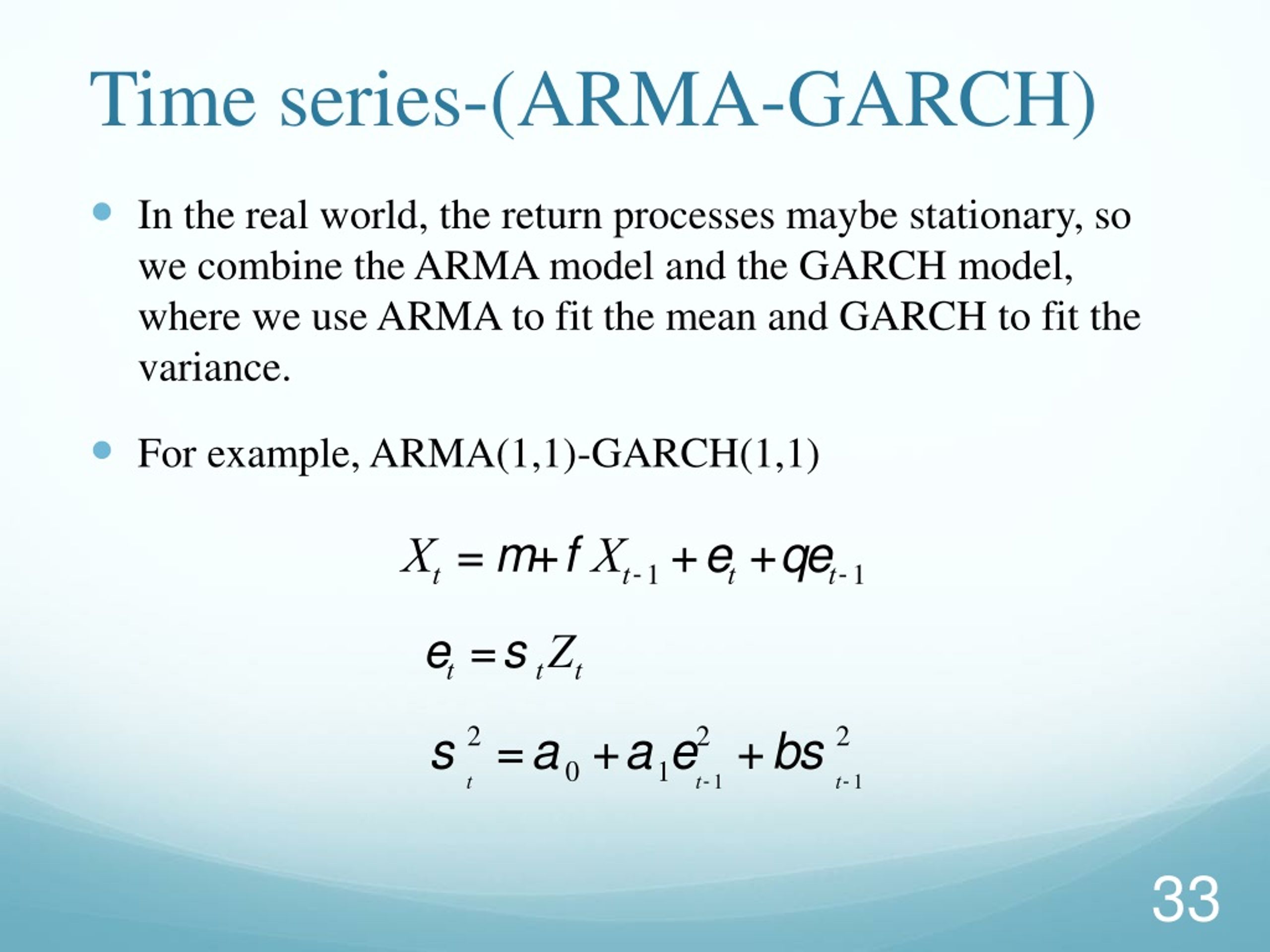

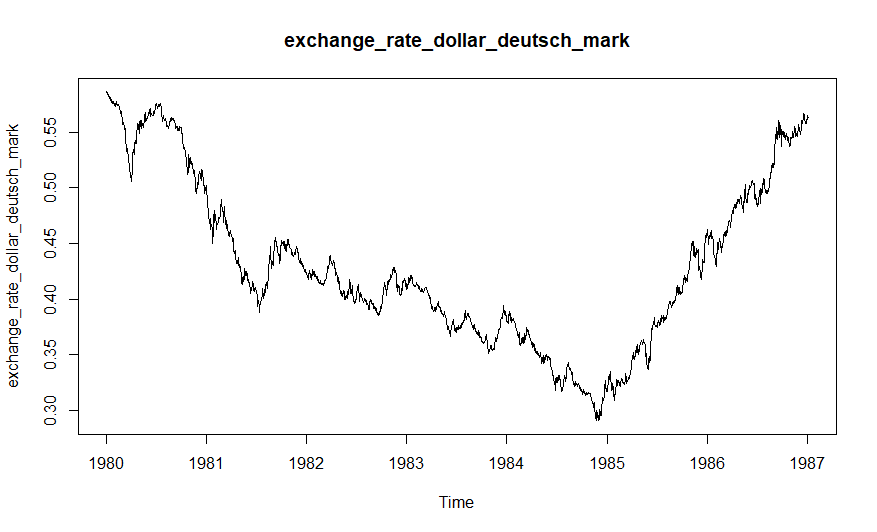

Is garch a time series model. Provides a comprehensive and updated study of garch models and their applications in finance, covering new developments in the discipline. In econometrics, the autoregressive conditional heteroskedasticity (arch) model is a statistical model for time series data that describes the variance of the current error term or innovation as a function of the actual sizes of the previous time periods' error terms; Arma is a model for the realizations of a stochastic process imposing a specific structure of the conditional mean of the process.

The main aim of this study was to assess the. Arch and garch models have become important tools in the analysis of time series data, particularly in financial applications. These models are especially useful when the.

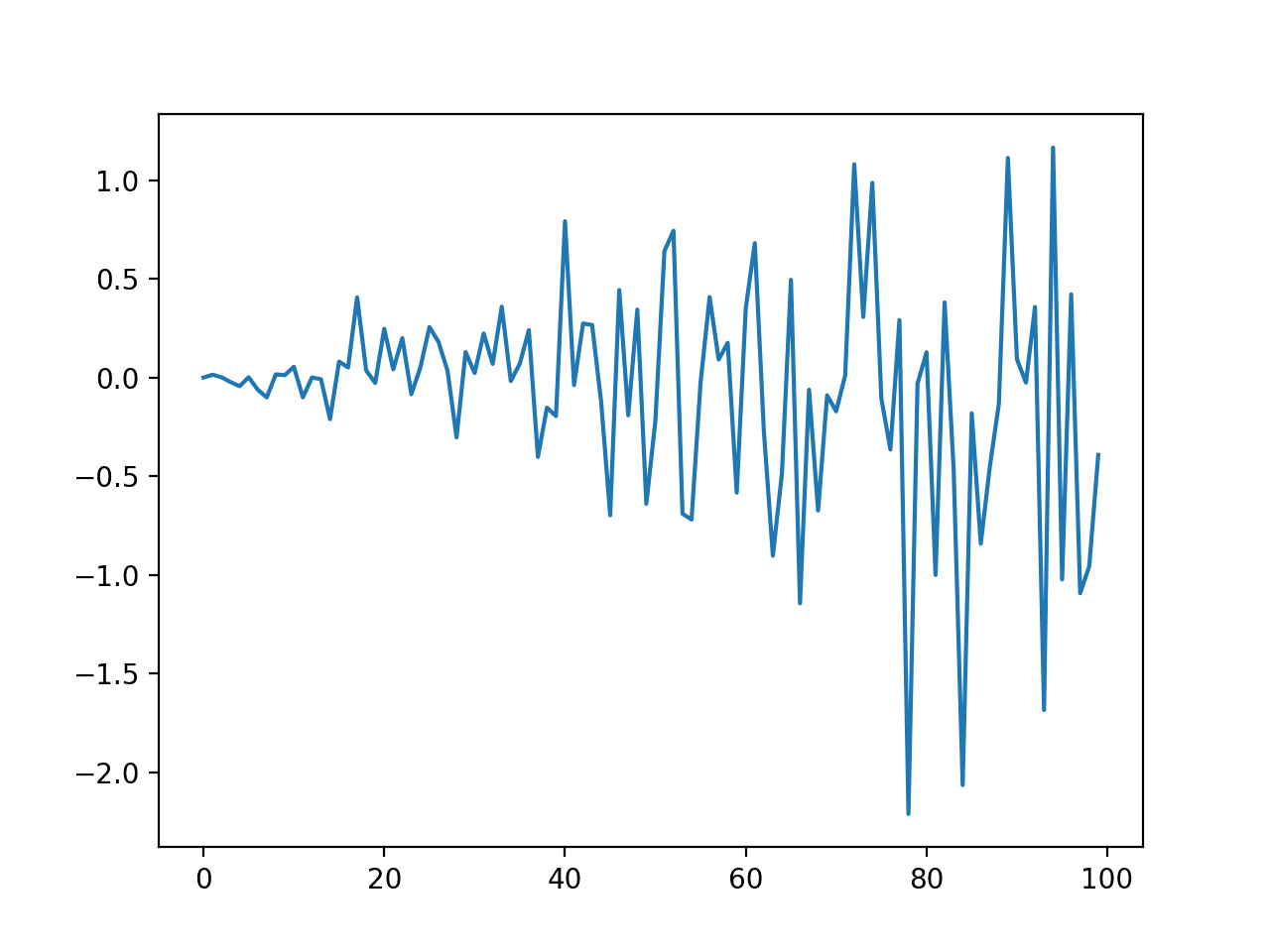

It incorporates lagged values of the series to make predictions. It is not time varying. The aim of this study is to enhance the understanding of volatility dynamics in commodity returns, such as gold and cocoa, as well as the financial market index.

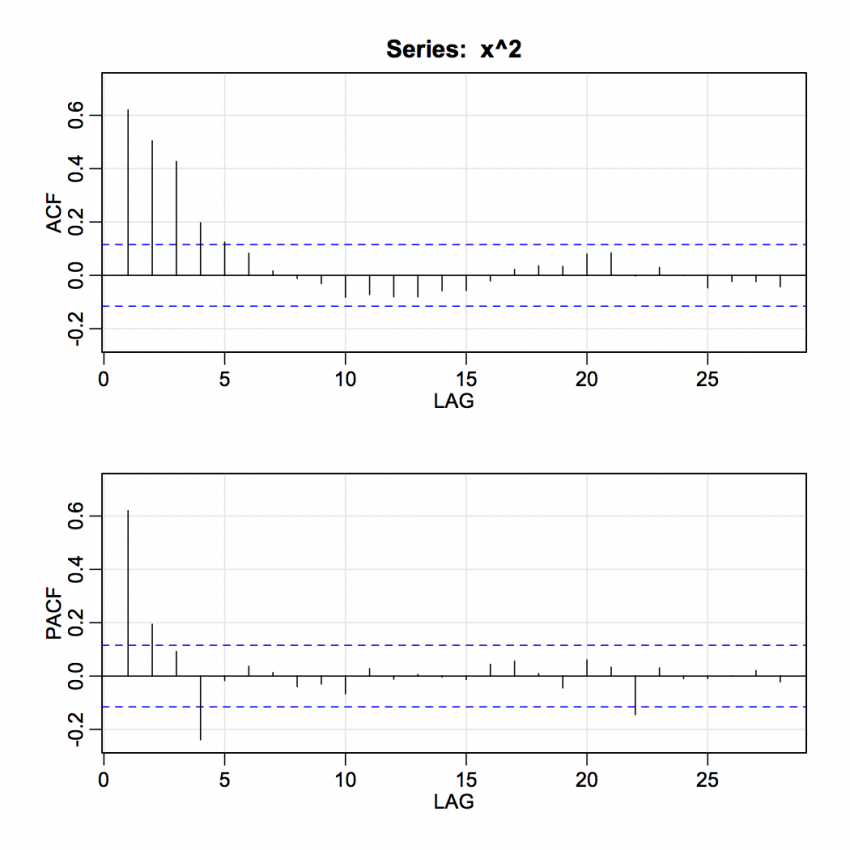

The arch model is appropriate when the error variance in a time series follows an autoregressive (ar) model; Industry development indicators refer to a set of measures used to assess the performance and growth of industries. Local projection impulse response (lpirf) analysis.

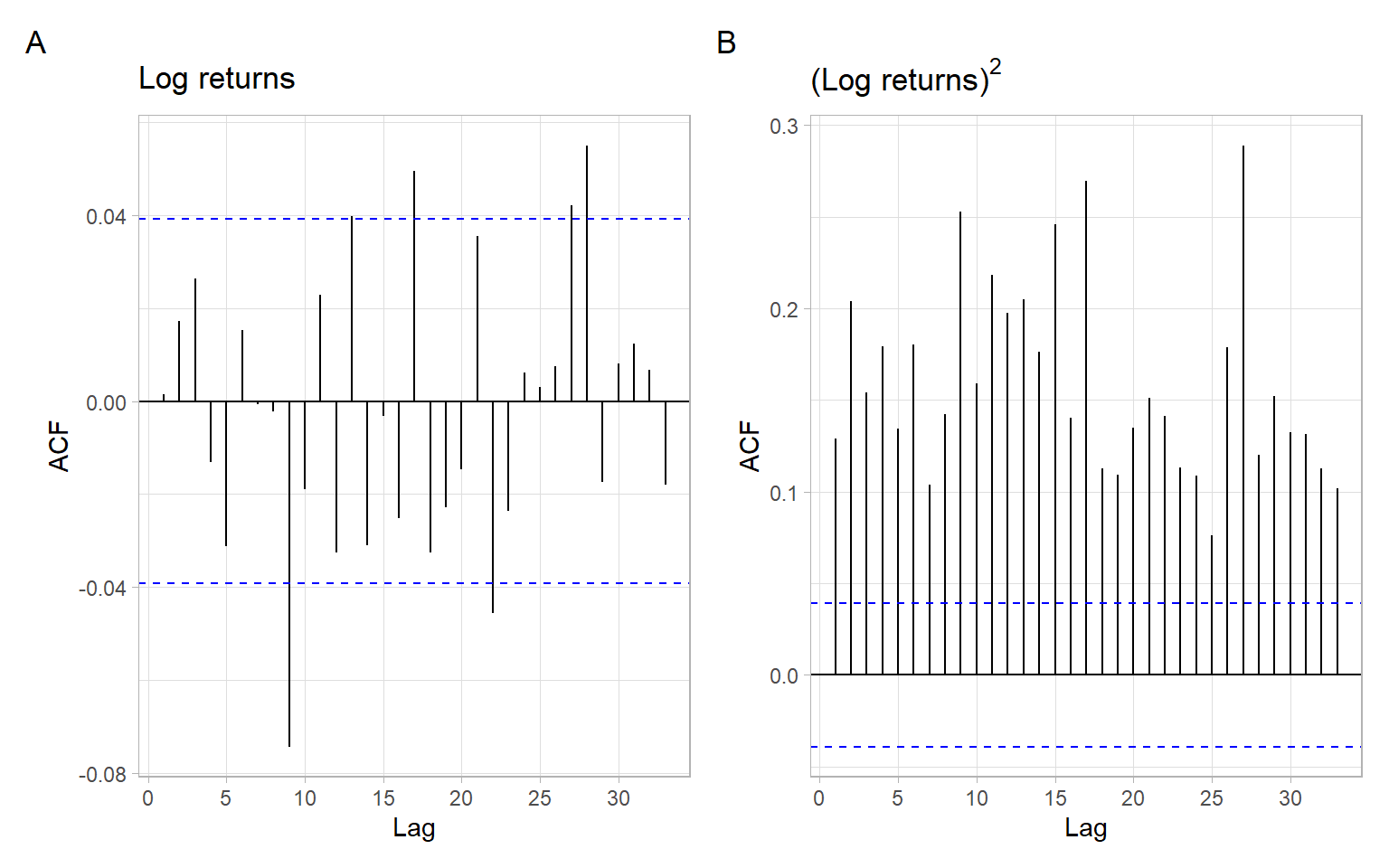

Garch models are the generalization of arch models. Autoregressive conditional heteroskedasticity (arch) and its generalized version (garch) constitute useful tools to model such time series. 3.4 generalized autoregressive conditional heteroskedasticity (garch) models and extensions | timeseries.

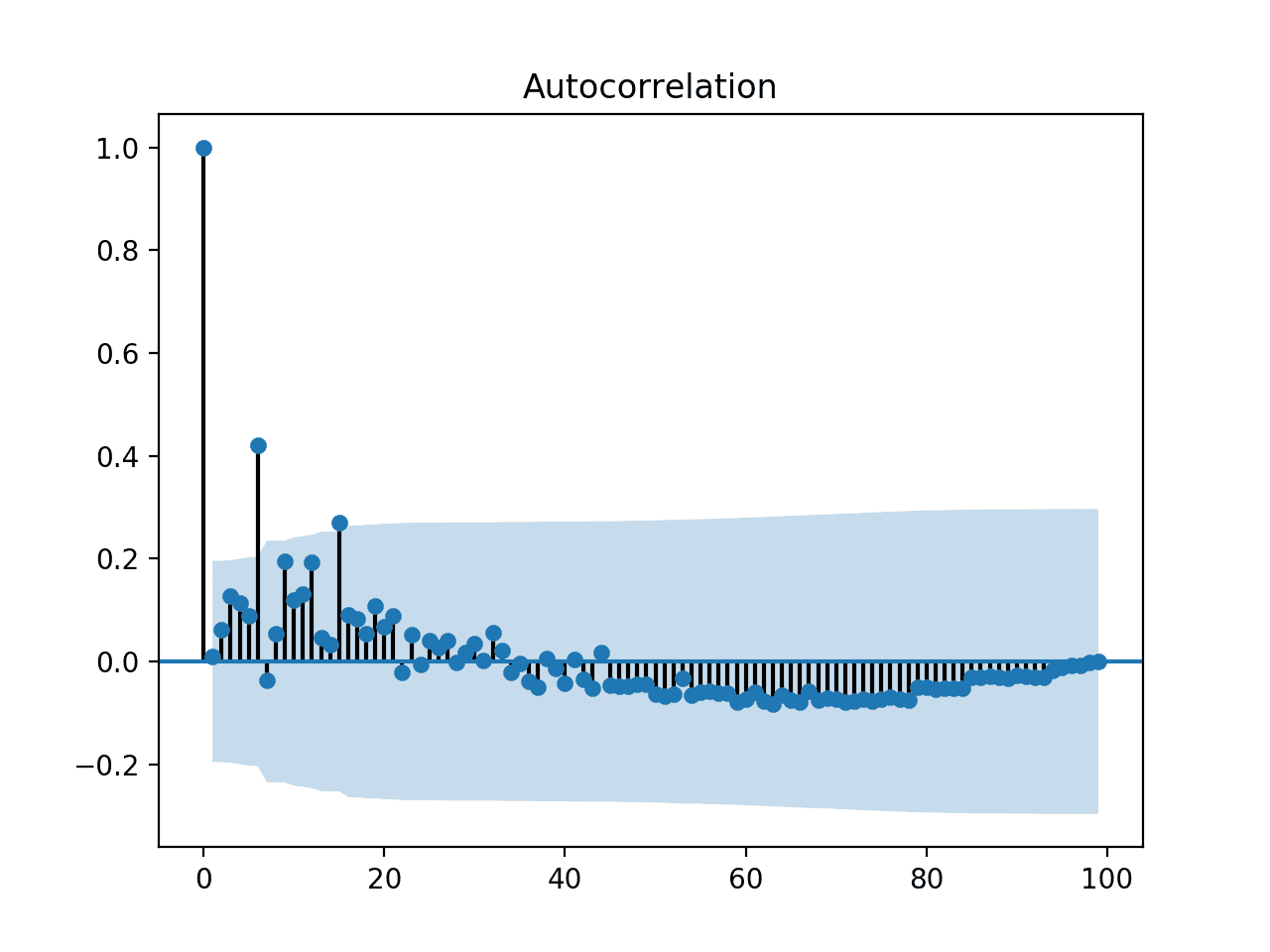

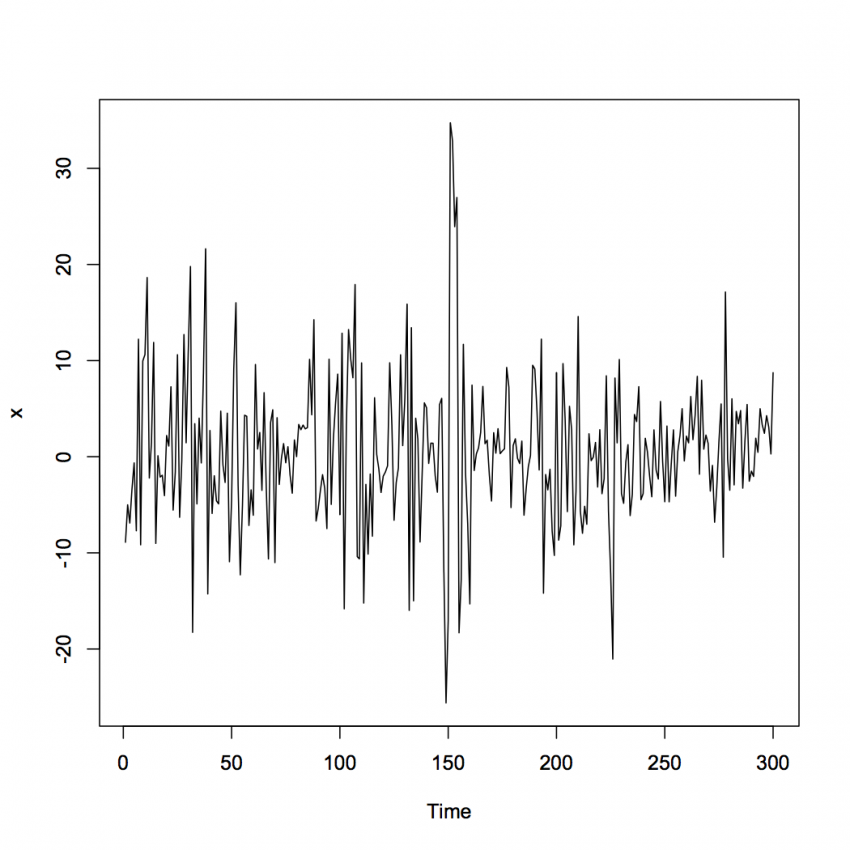

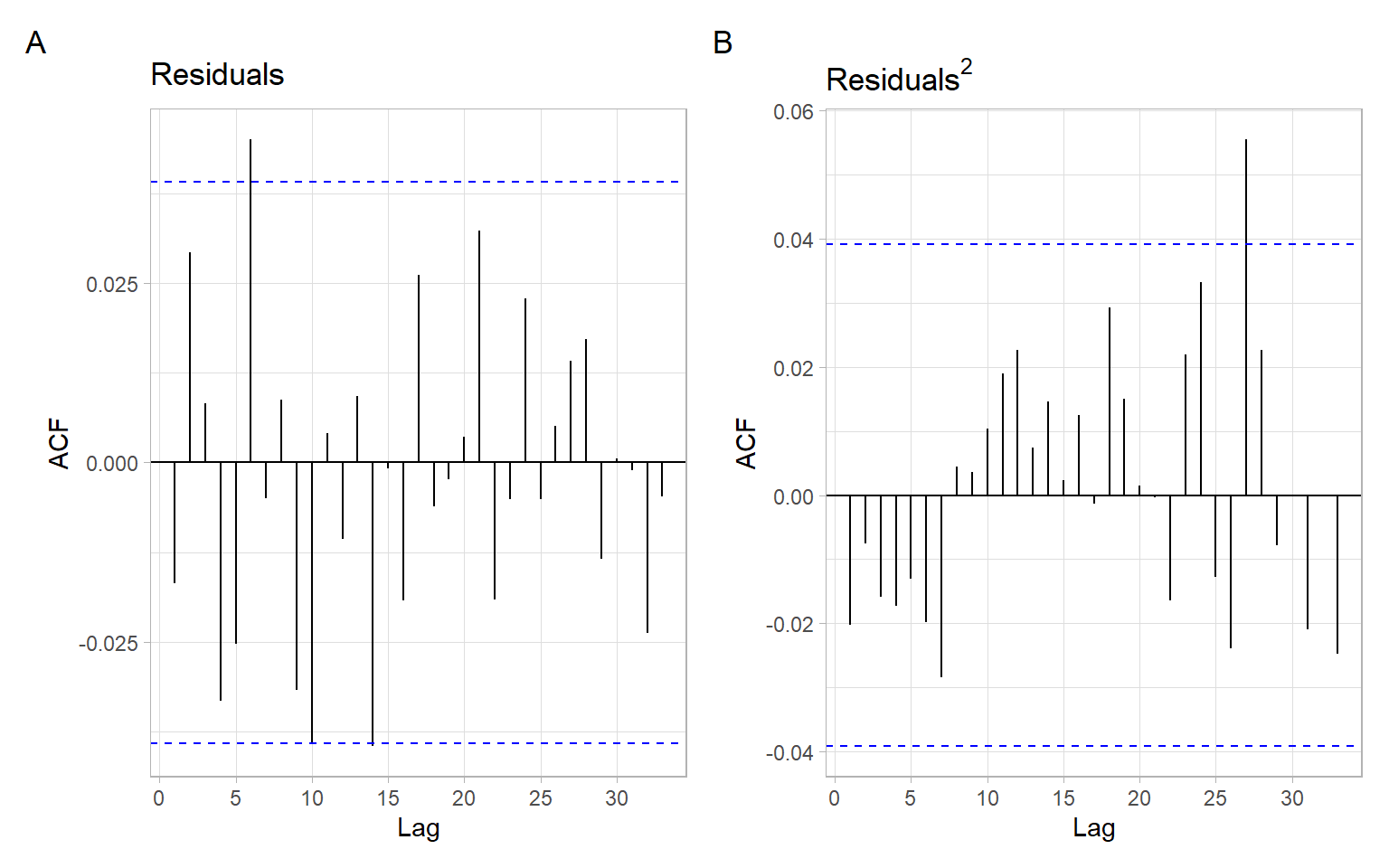

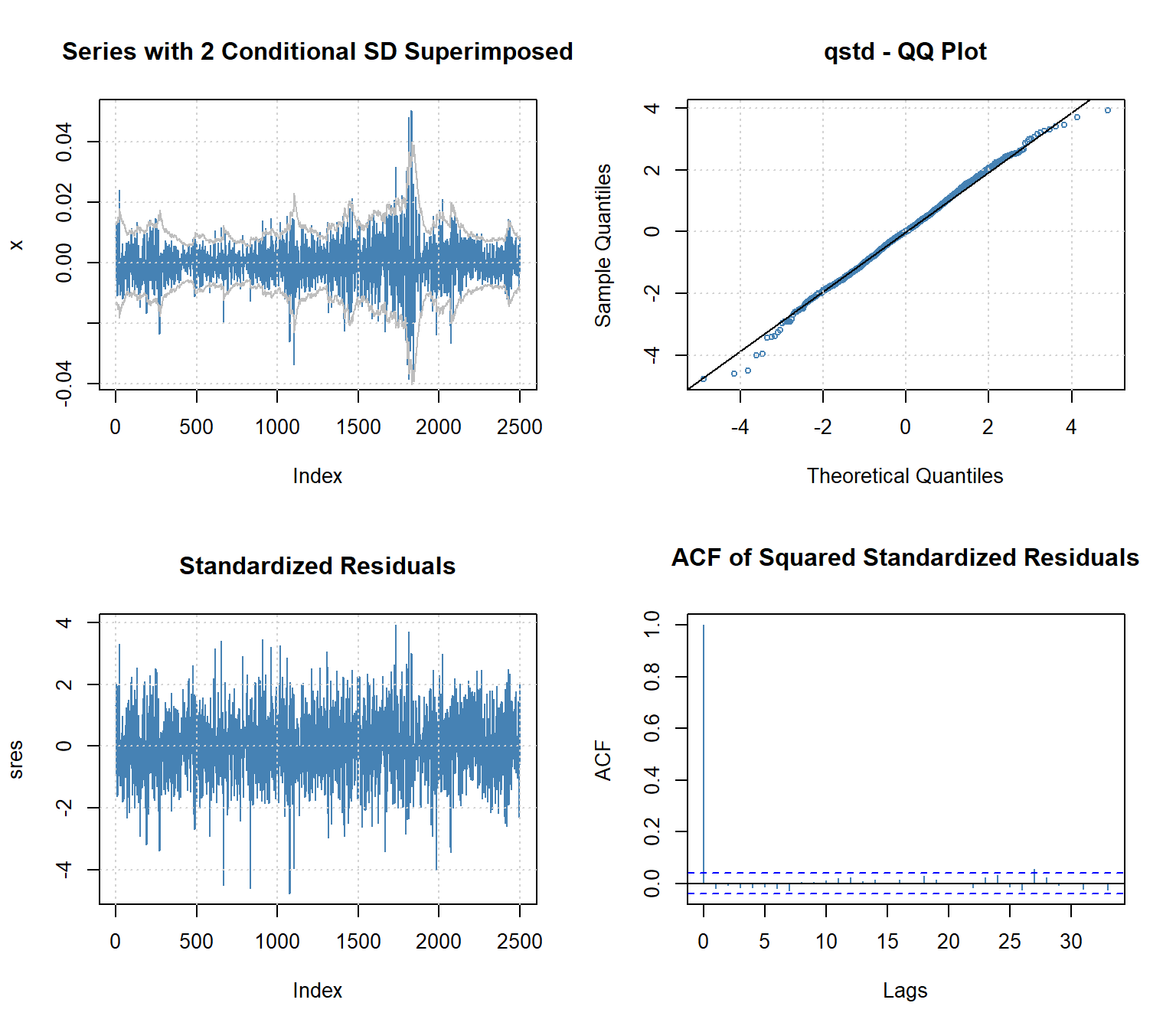

Garch has also proven efficient for financial time series, since it can extract more complex patterns from a time series compared to arma and arima models. Eviews 14 supports estimation of impulse responses via local projection (jordà 2005) using both standard sequential and. We are going to describe a mechanism for detecting conditional heteroskedastic series in this article and then use the arch and garch models to account for it, ultimately.

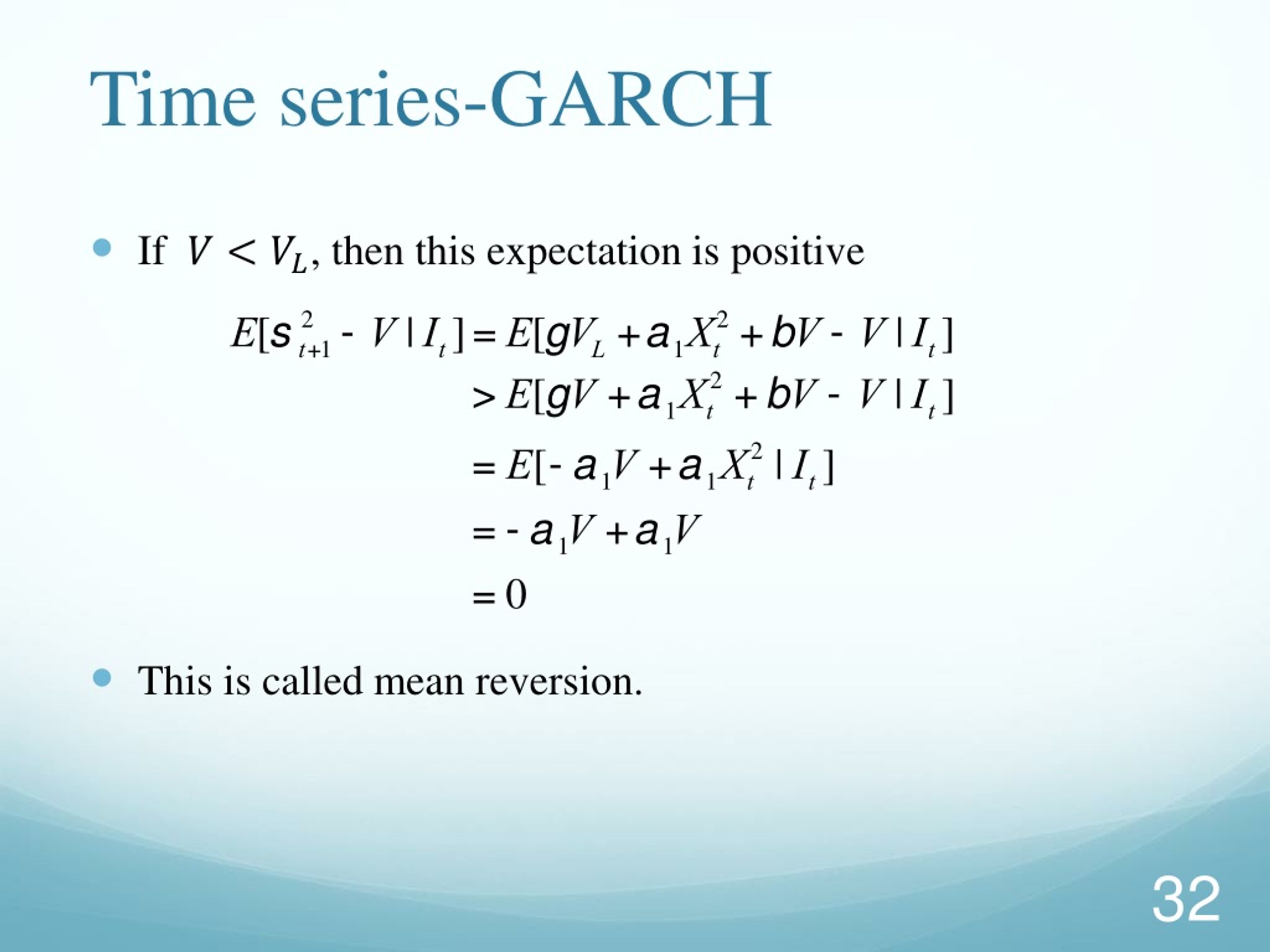

Garch is used extensively within the financial industry as many asset prices are conditional heteroskedastic. You can compute it directly using the expectation formula.

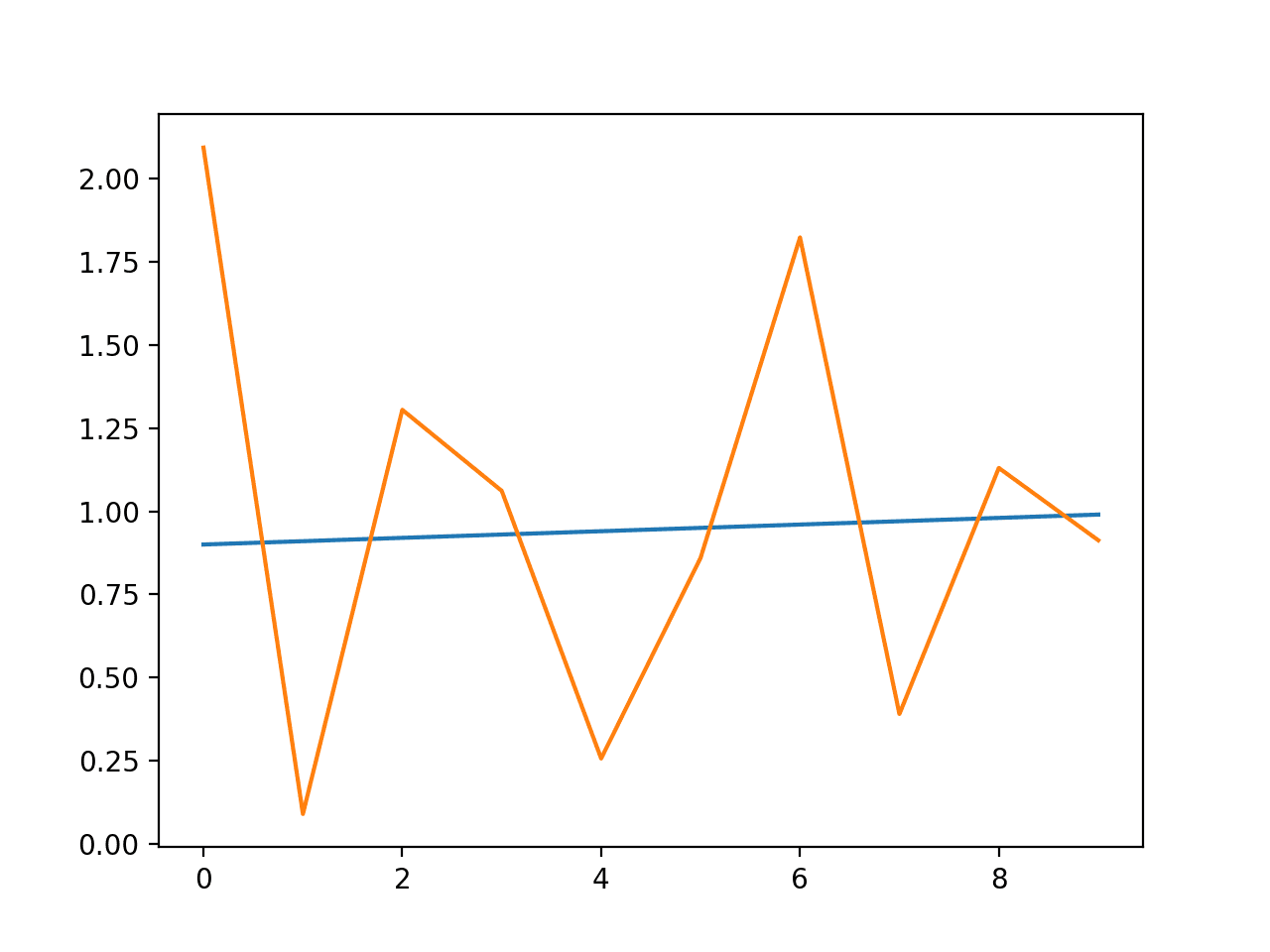

Arch is an autoregressive model with conditional heteroskedasticity. Often the variance is related to the squares of the previous innovations. We look at estimation of (g)arch models.

To understand the need for garch models, consider first a. 23.1 garch (m, r) we now examine the garch model in more. The conditional mean process refers to the expectation of the serie at time $t$ given.

Like the arima model, the garch model is a time series model. If an autoregressive moving average Chapter 23 garch models | time series analysis.