Matchless Info About Which Is Better Lstm Or Arima For Stock Prediction How To Create A Line Graph On Google Docs

Is lstm better than arima?.

Which is better lstm or arima for stock prediction. Using lstm and arima models for stock forecasting. Arima model is a class of linear models that utilizes historical values to forecast future values. Every model has its own advantages and disadvantages.

While arima offers a clear, interpretable model structure, lstms dive into. We applied these models to two synthetic and. Comparing arima and lstm:

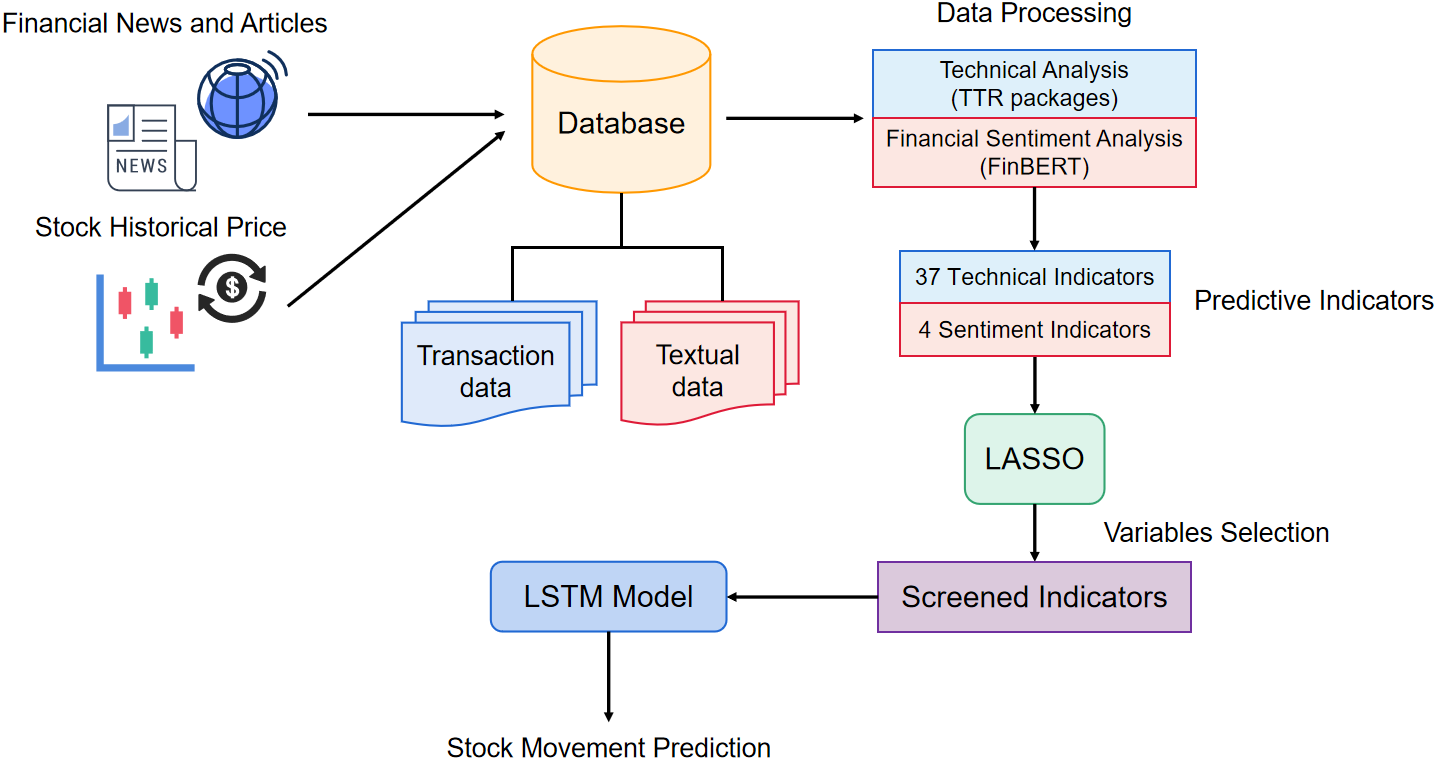

In the end, it is believed that the lstm model may have the best predictive ability, but it is greatly affected by the data processing. Whereas, despite providing better accuracy than lstm, the arima model. To train and predict stock price and stock price sub correlation, the arima.

The combination of time series and external factors may be a worthy research direction. Arima stands for autoregressive integrated moving average,. The lstm model provides better results when the data set is large and has fewer nan values.

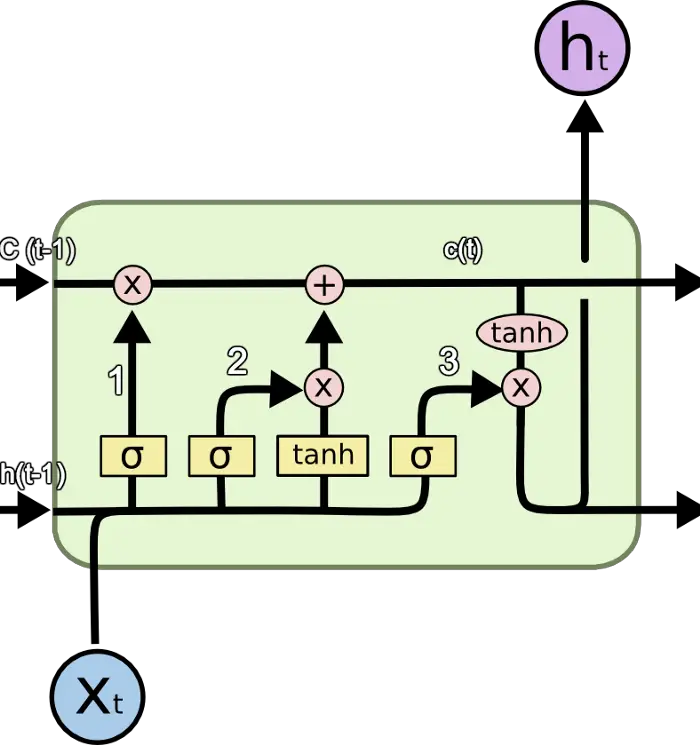

While arima relies on the relationships between lagged values of a time series, lstm is an artificial neural network that recognizes patterns in sequences of. To begin, stock samples from the national stock exchange from 2010 to 2019 are collected. The ann model performs better than that of the arima model.

Arima, which stands for autoregressive integrated moving average, is a classic time series forecasting method that captures various market forces and inertia. Arima’s statistical framework relies on the stationarity of time series, while lstm’s deep learning model thrives on the sequential nature of the data, learning from. A comparison of artificial neural network and time series models for forecasting commodity prices compares the performance of ann and arima in predicting financial time series.

In this content, we compared two popular and powerful models for time series prediction: