Smart Tips About Which Chart Pattern Is Most Bullish Add Target Line To Excel

Candlestick charts are among the most popular style of charts and widely used by today's traders.

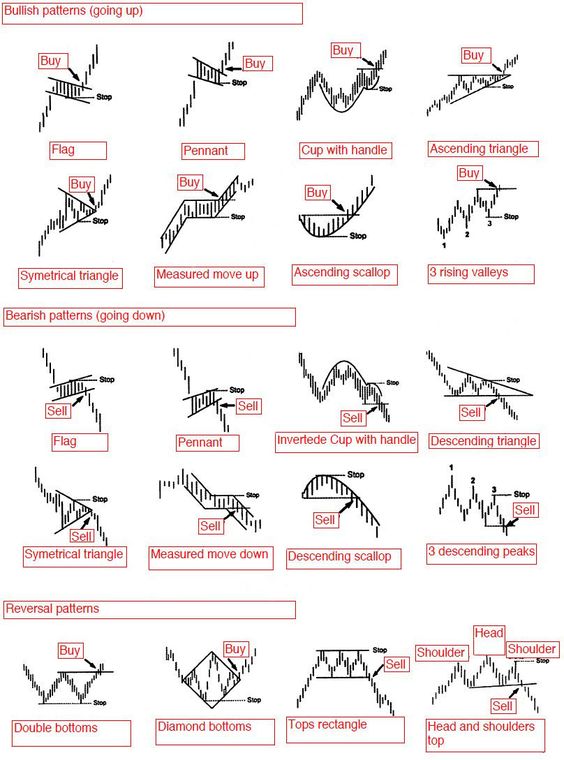

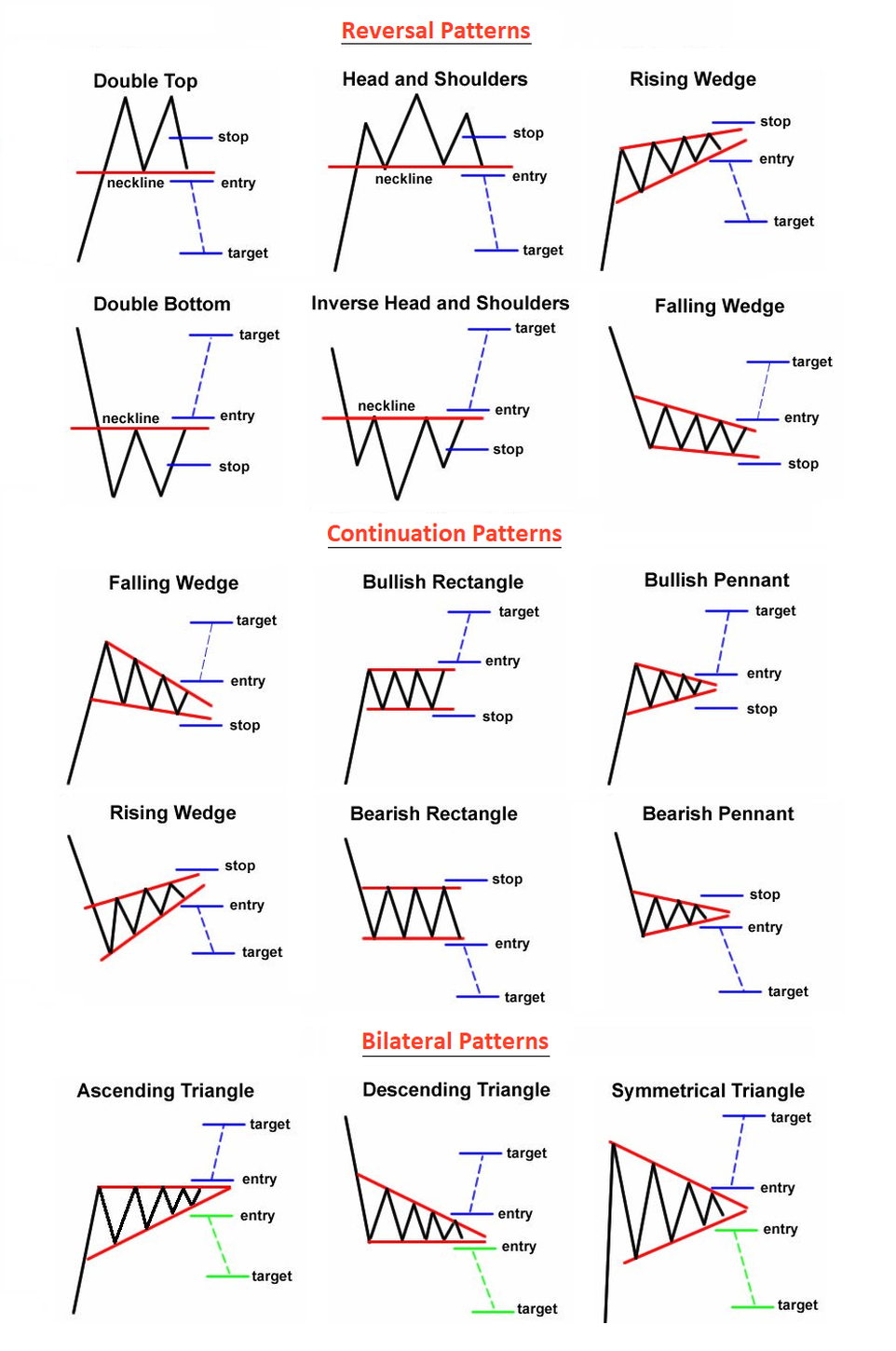

Which chart pattern is most bullish. Looking to gain a better understanding of bullish candlestick patterns? What is the most bullish candlestick pattern? There are two categories of patterns in terms of price action:.

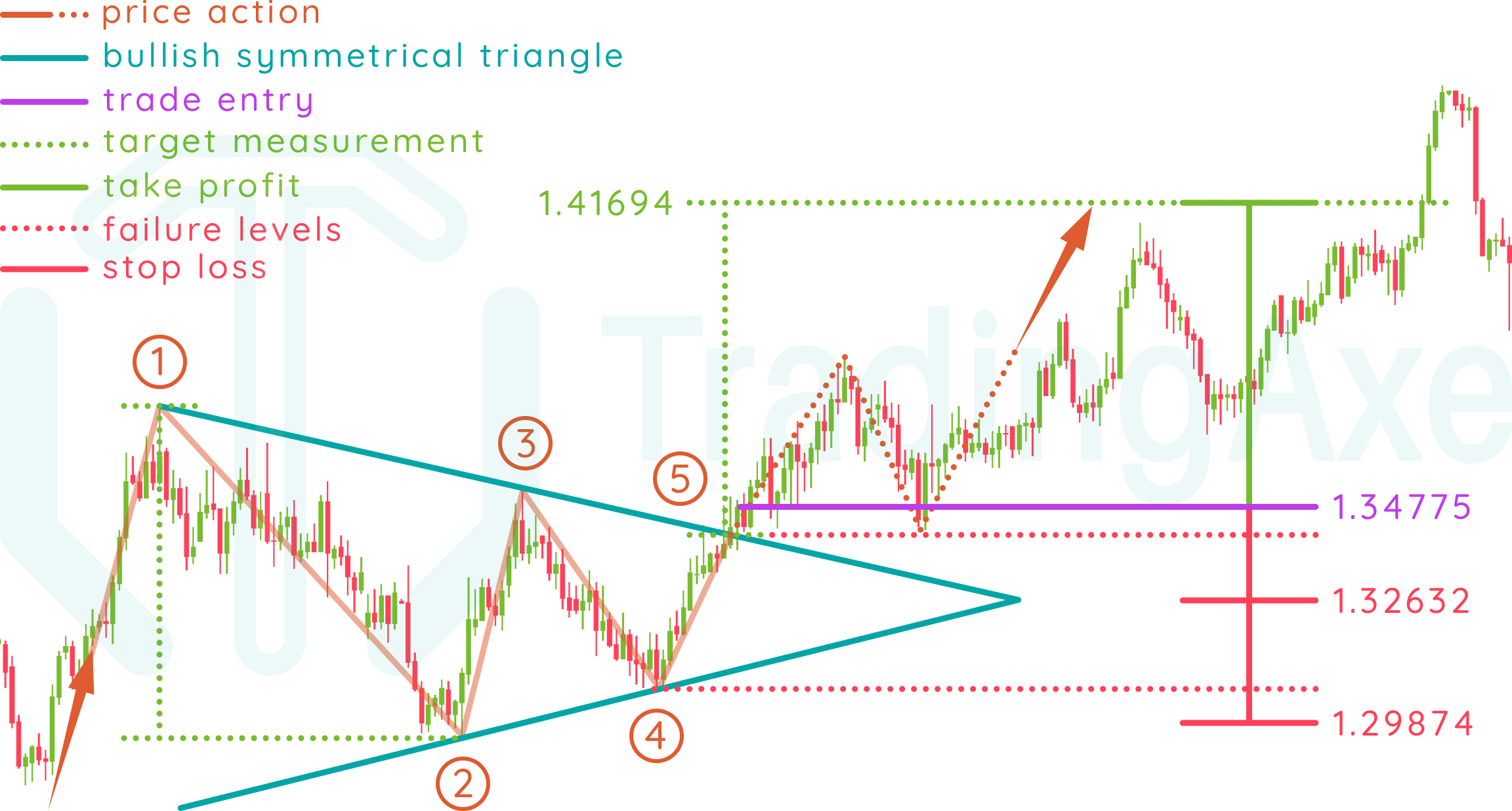

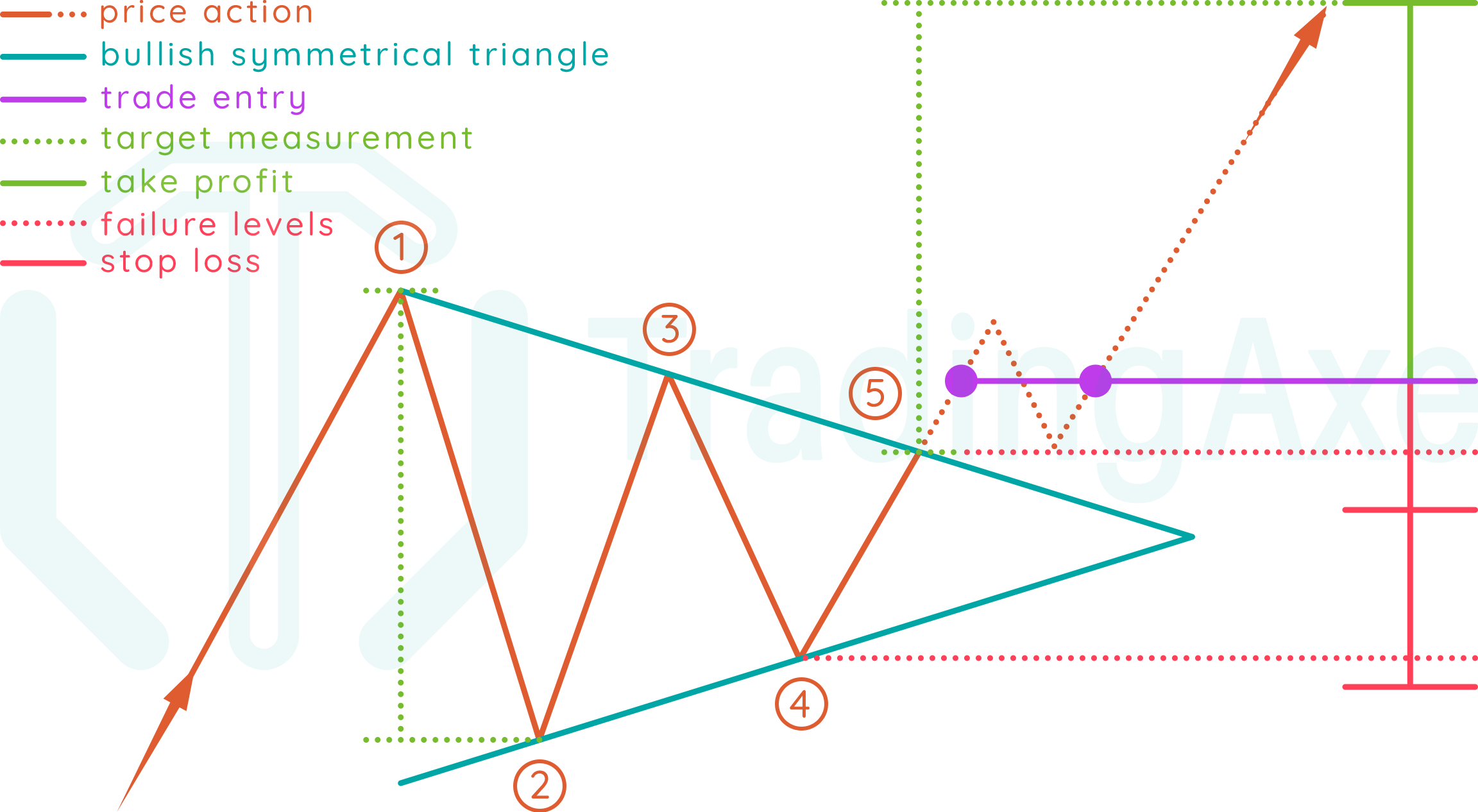

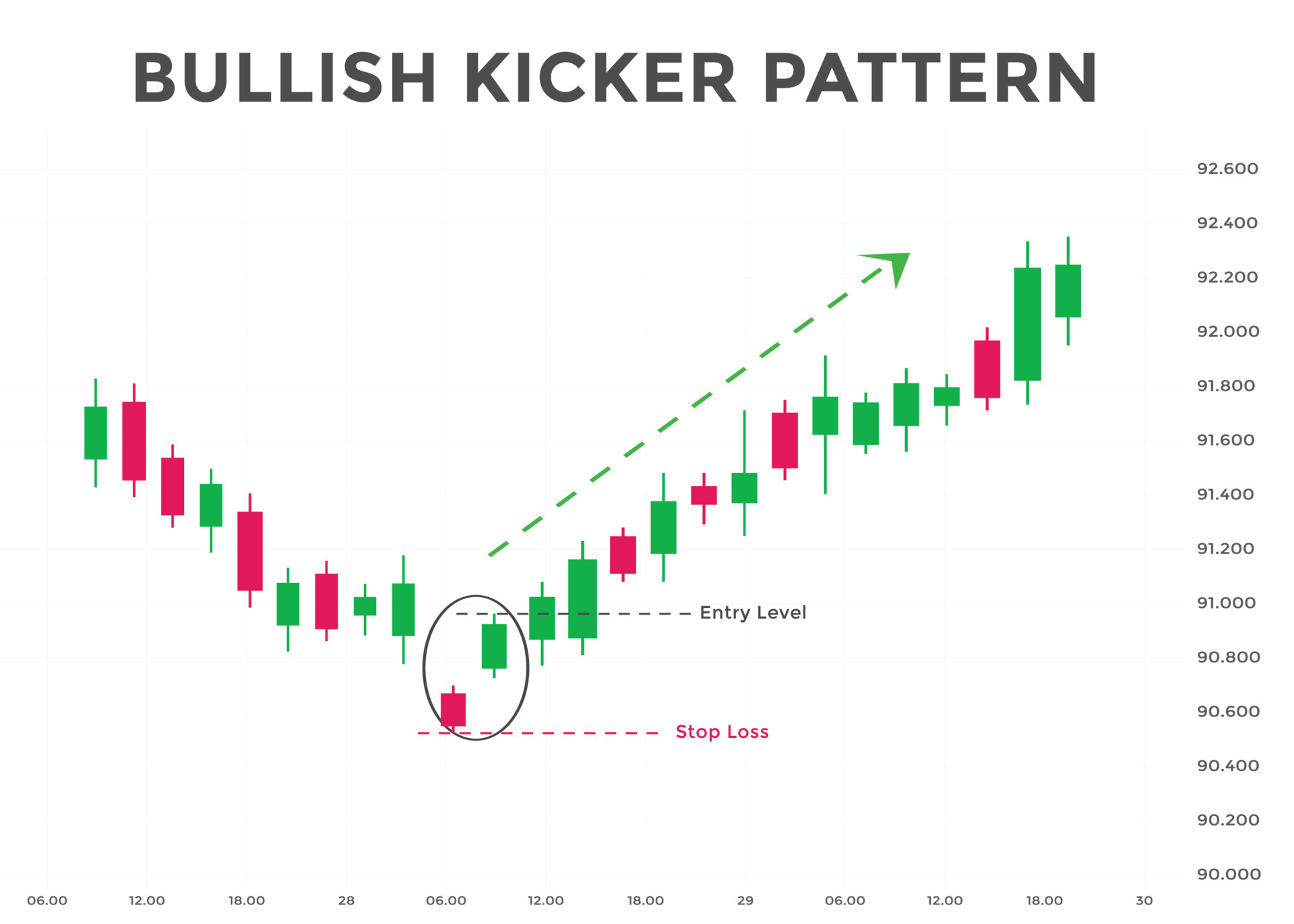

Elliott wave analysis jun 25, 2024. The following chart shows a bullish gartley pattern with an entry level, stops and target zones. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong.

The formation of a hammer pattern is considered a technical indication of nearing a bottom with likely subsiding of selling pressure. Nvidia's chart shows the stock has cleared a 92.22 buy point. The week of dec.

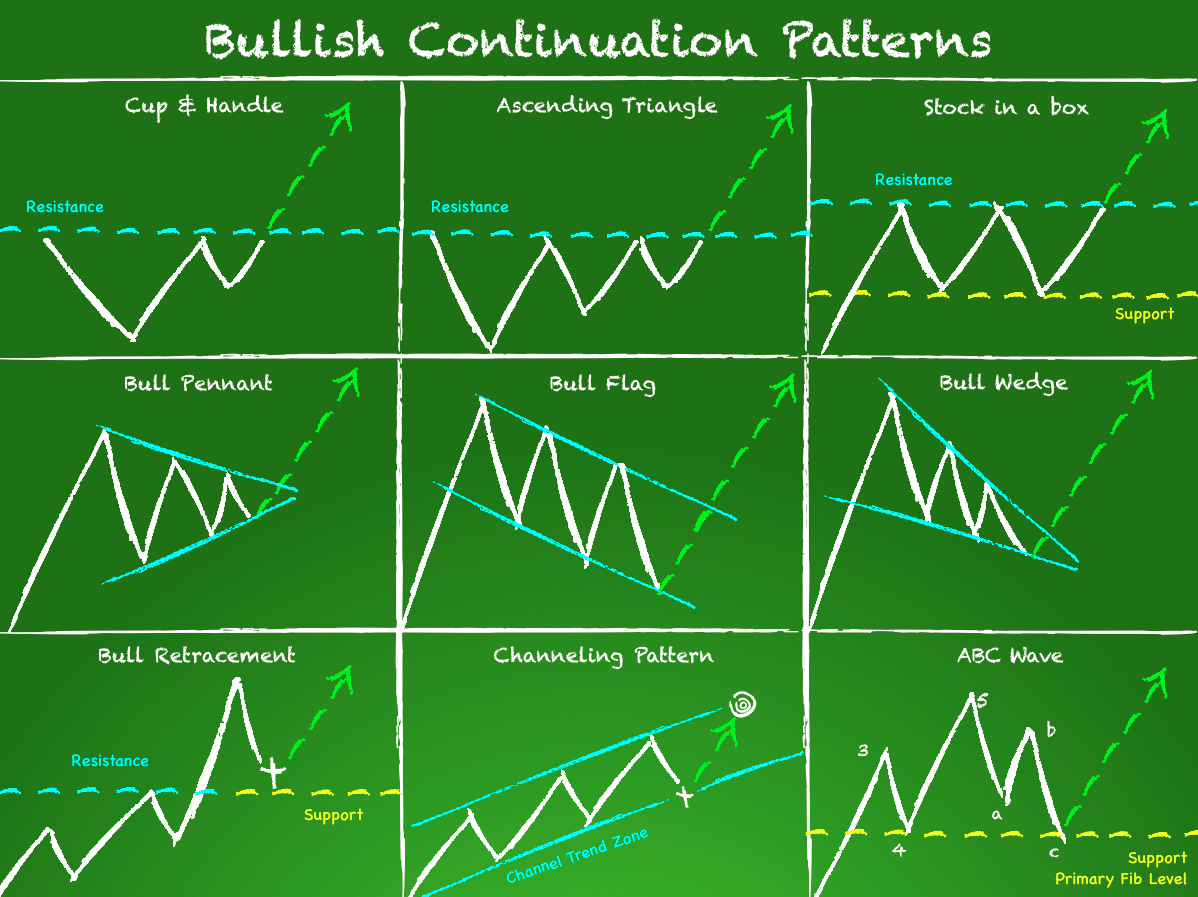

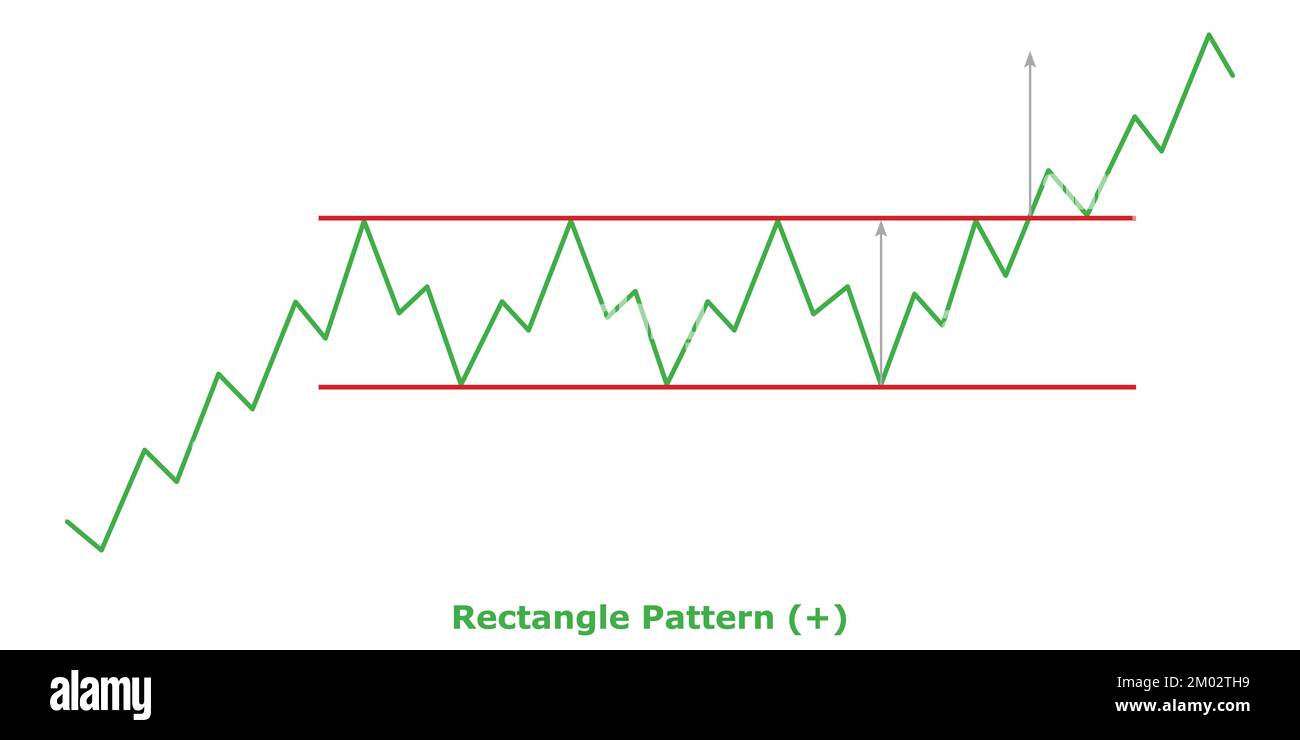

Bullish chart patterns are technical formations that tend to evoke upward price movements in a stock. The rectangle pattern is complete when price breaks the resistance line in a bullish rectangle, or when price breaks the support line in a bearish rectangle. The target zones are projected using xa swing length and fibonacci ratios.

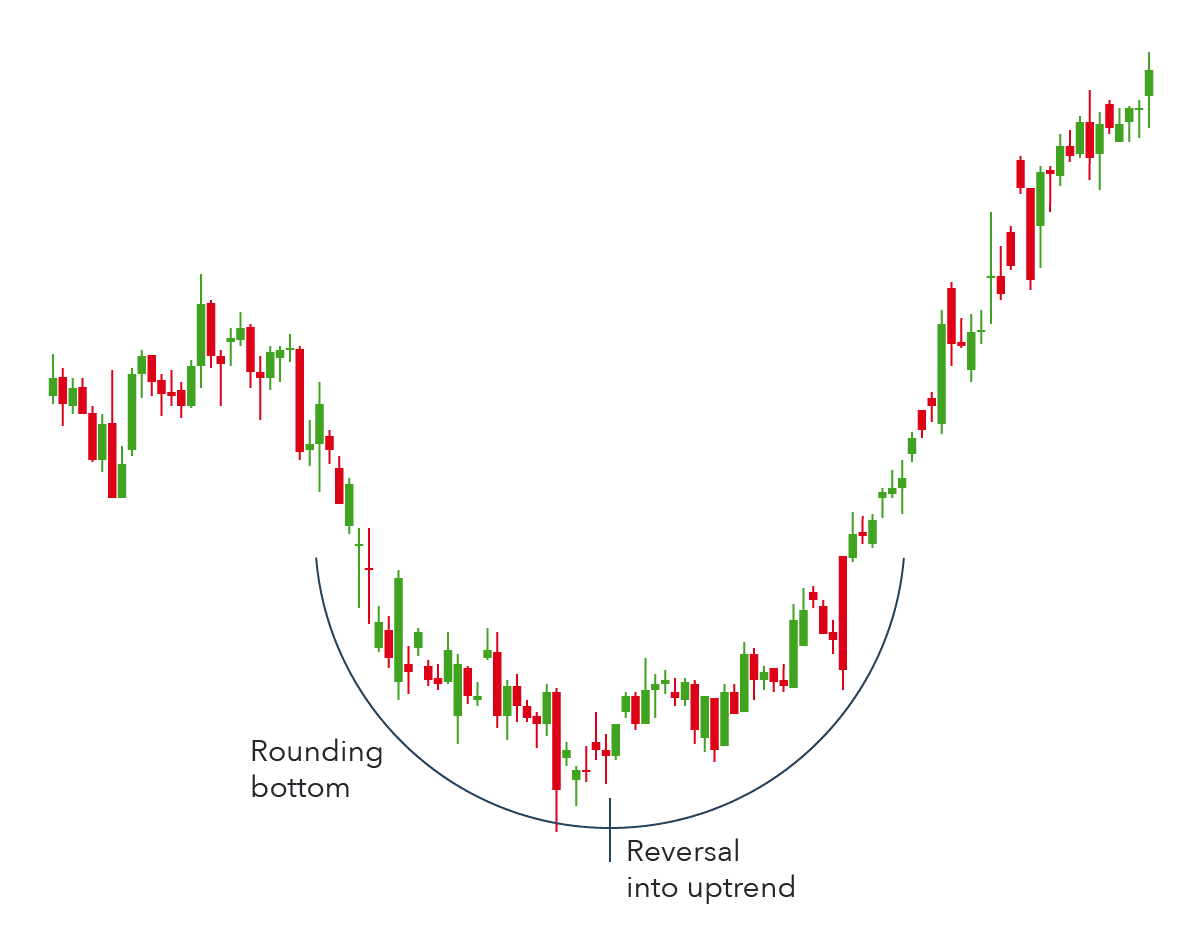

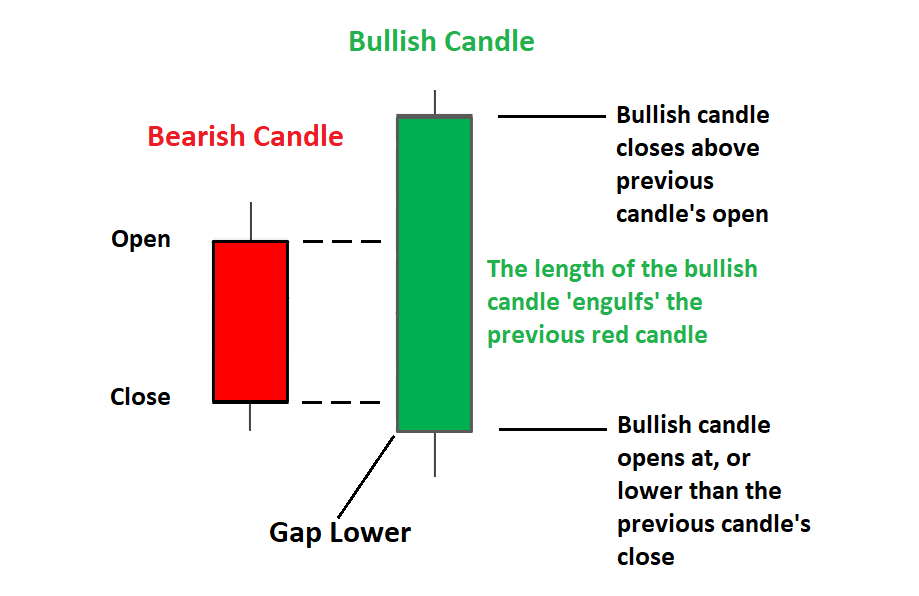

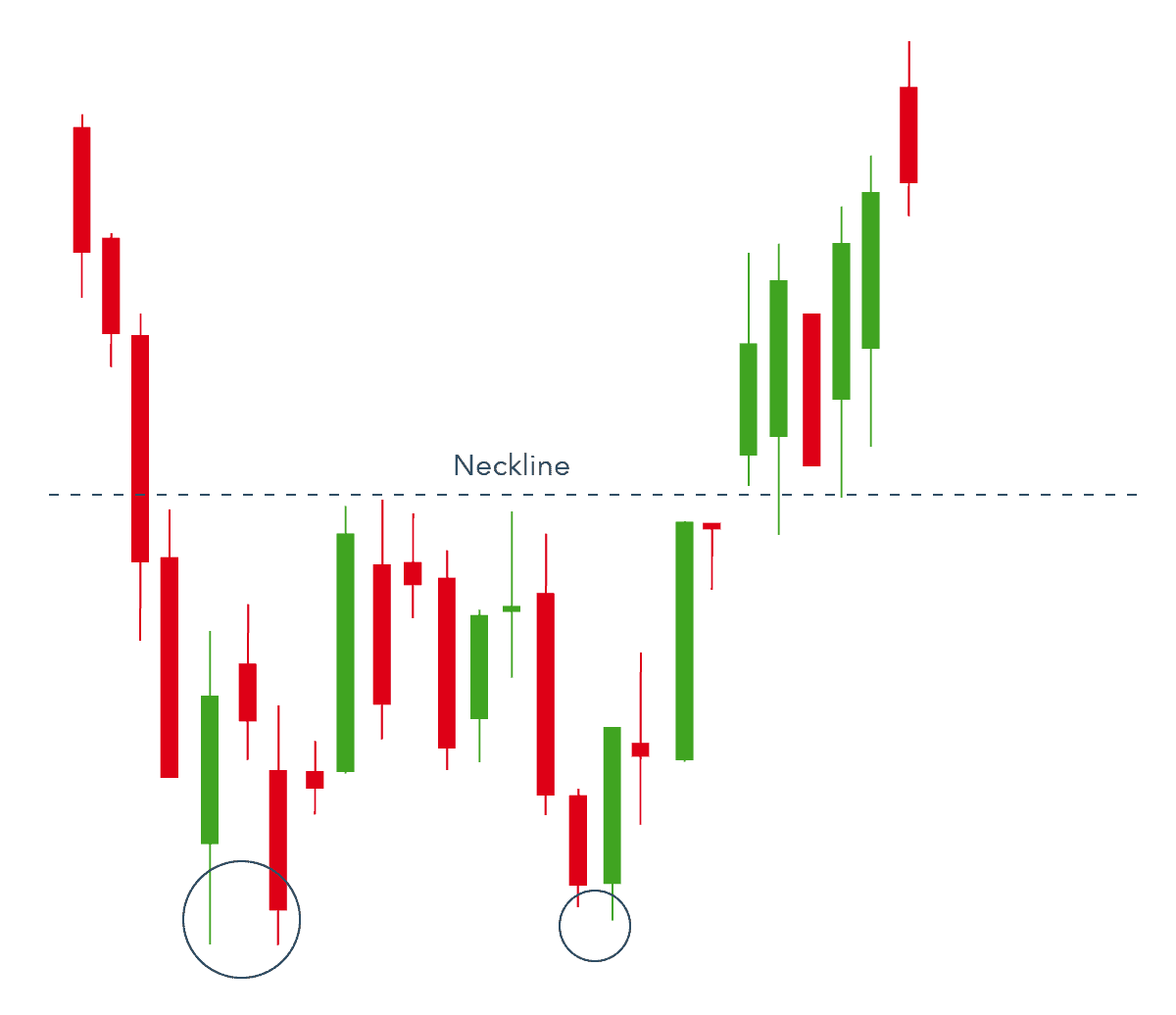

A cup and handle is a bullish reversal chart pattern which resembles a cup and handles where the cup is in the shape of a “u” and the handle has a slight. The most bullish candle patterns are the inverted hammer (60% bullish), the shooting star (57.1% bullish), and the bearish engulfing and bearish marubozu (57%. The inverted head and shoulders is the most bullish pattern.

What are the bullish chart patterns? A bullish flag pattern occurs when a stock is in a strong uptrend, and resembles a flag with two main components: 22, meta stock had climbed 7% from the buy point.

8 strongest candlestick patterns. It has a success rate of 83%. Learn how these patterns work and which 8 ones you should know.

Shares started a pause, as the stock was little changed the next week (2), up less than 0.2%. The pole and the flag. But this is not the only factor.

A double bottom chart pattern indicates a period of selling, causing an asset’s price to drop below a level of support. The stock is already extended,. Chart patterns are a good way of telling when to buy or sell a stock.

Dating back to the early 18th century, the candlestick no. A bullish rectangle chart pattern is a type of technical analysis pattern that signals a potential trend continuation and serves as a great trading opportunity. Here, i would like to show the most commonly used and highly profitable patterns for new traders (and advanced!).

/dotdash_Final_Bullish_Harami_2020-8e7ee8e18daf483288e4962f3ebc8be2.jpg)