Best Info About Is Trendline Good For Trading Horizontal Axis Labels Excel

When used correctly, they're a helpful, clear, and relatively simple tool for traders.

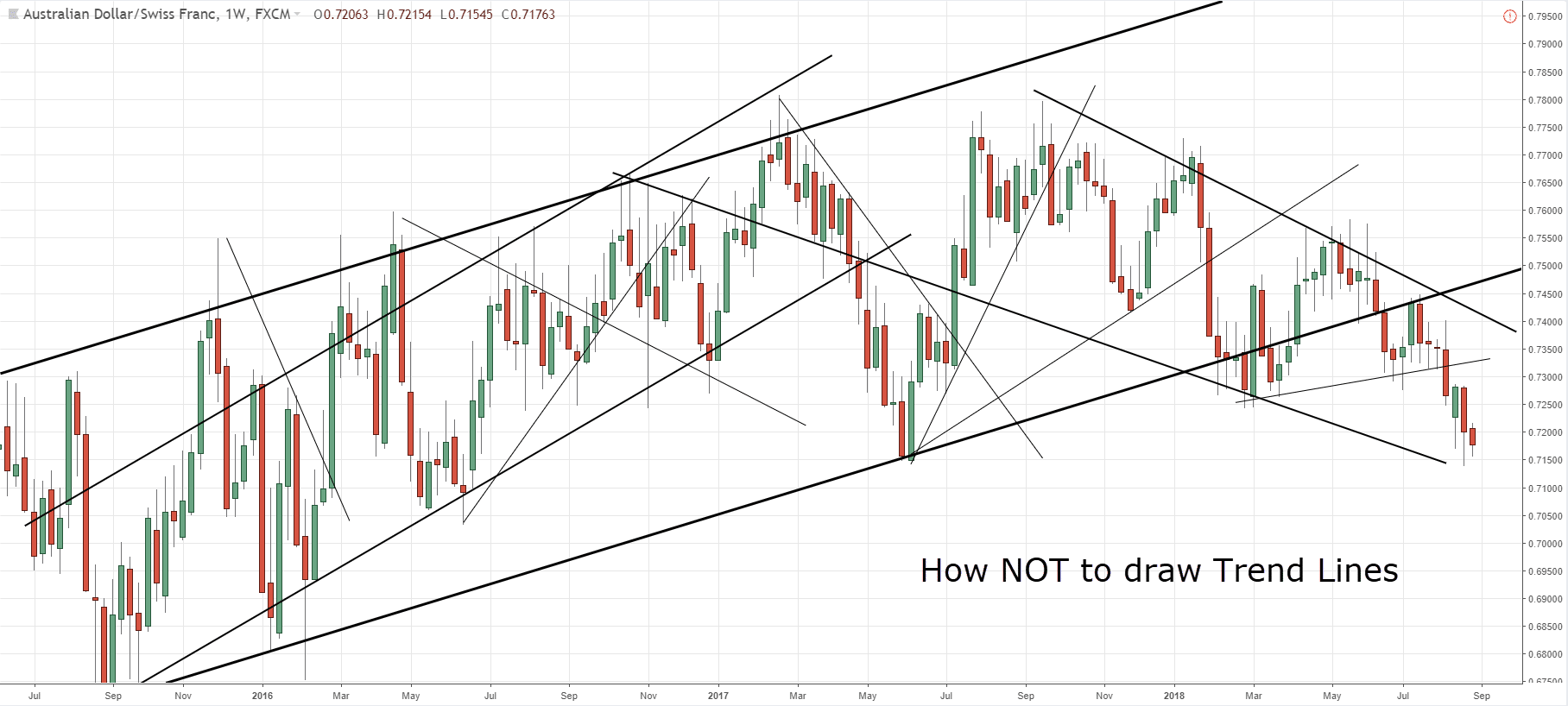

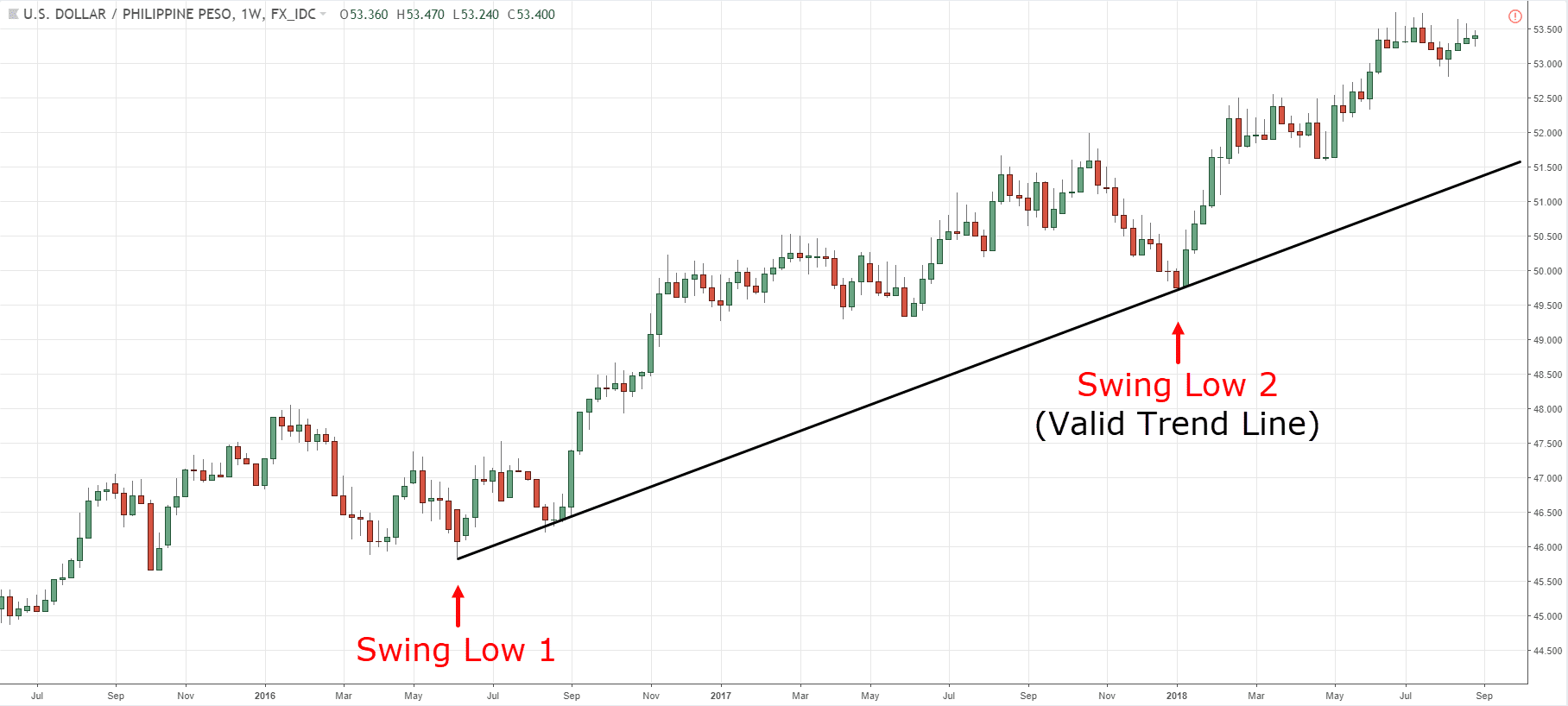

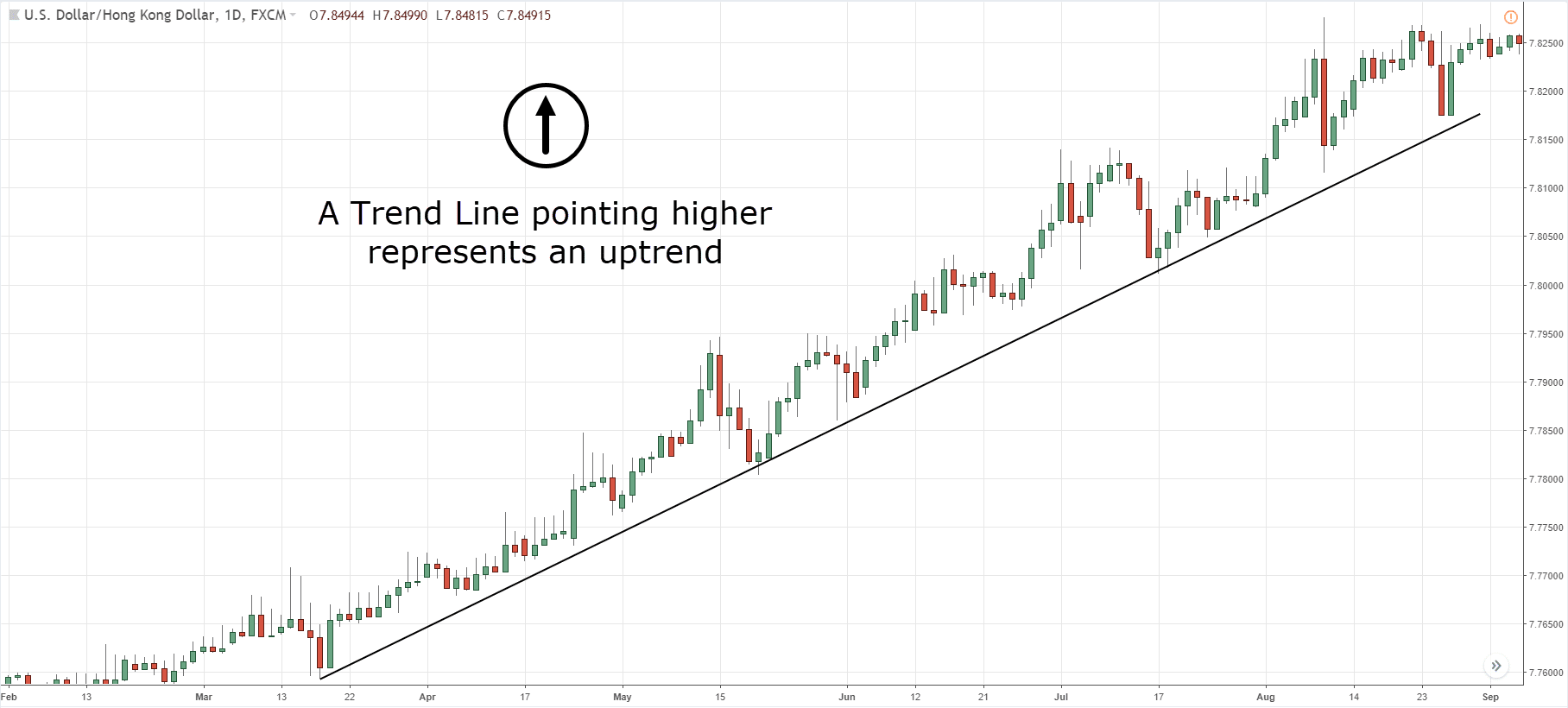

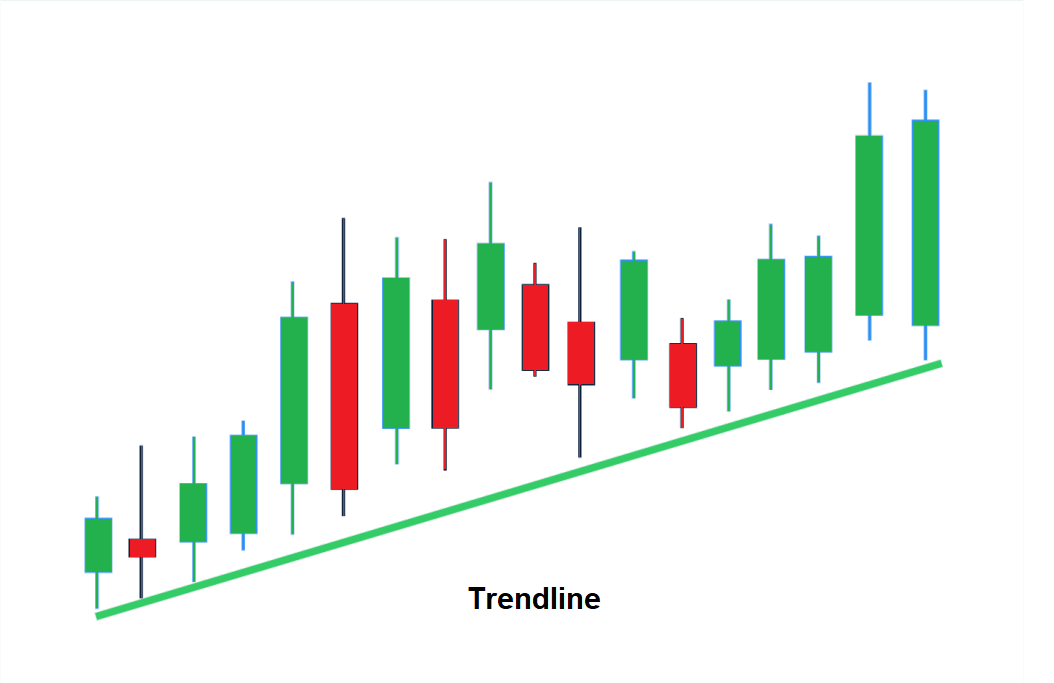

Is trendline good for trading. You can draw a trendline for an uptrend by connecting the lows on a price chart. Trend lines are one of the most universal tools for trading in any market, used in intraday, swing and position trading strategies. Used improperly, however, trendlines become ineffective and even counterproductive.

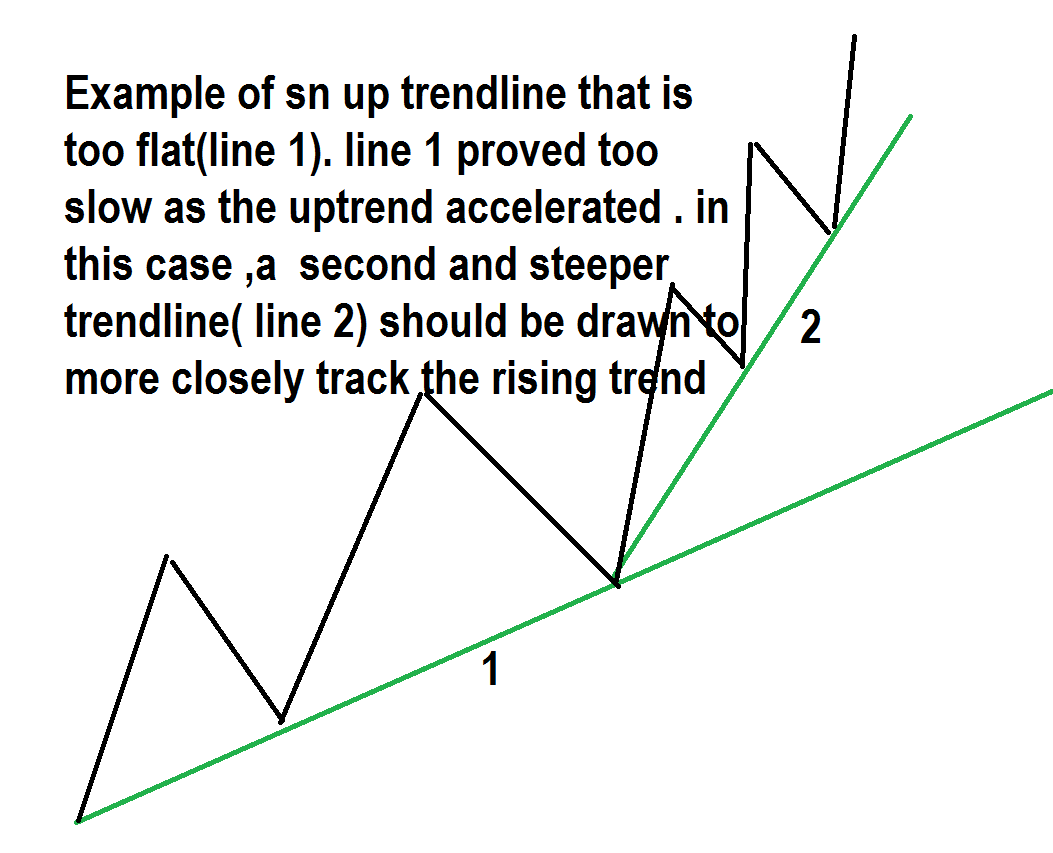

Using trendlines isn’t a science. How to use trend line to better time your entries. They also provide insights into whether an asset is a buy or sell at a specific price, and whether a trader should choose to buy or sell at a specific price in the future.

Trend lines are probably the most common form of technical analysis in forex trading. How to use trend line and identify trend reversal. Early trading has seen indices stabilise, with losses on the dow and nasdaq 100 halted for now, while the nikkei 225 is aiming to continue the strong gains seen earlier in the week.

Yes, the trendline might be very good for trading, especially if you are a price action trader, but we recommend backtesting your trading ideas. Trendlines are easily recognizable lines that traders draw on charts to connect a series of prices together. While anyone can start drawing lines haphazardly on a chart, using trend lines effectively takes skill, practice, and understanding.

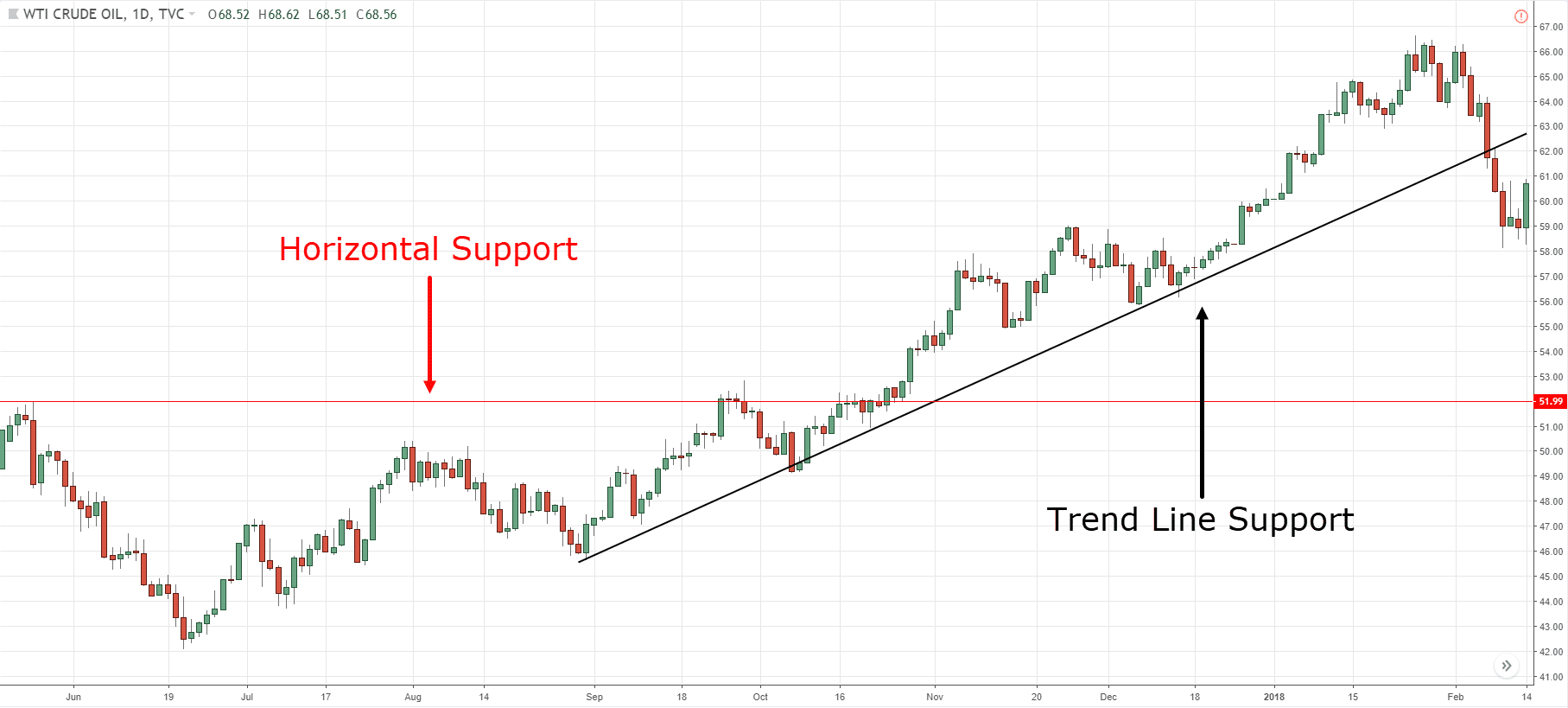

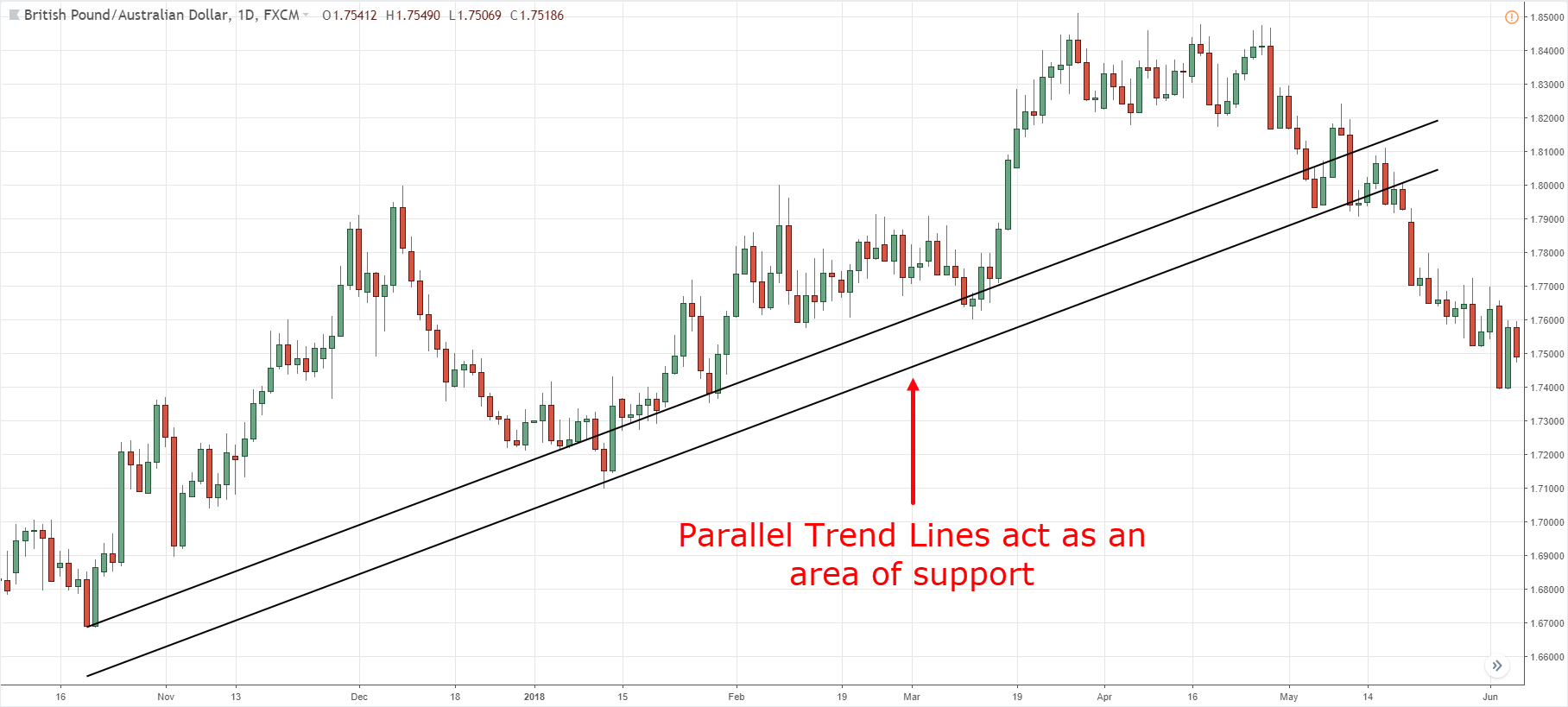

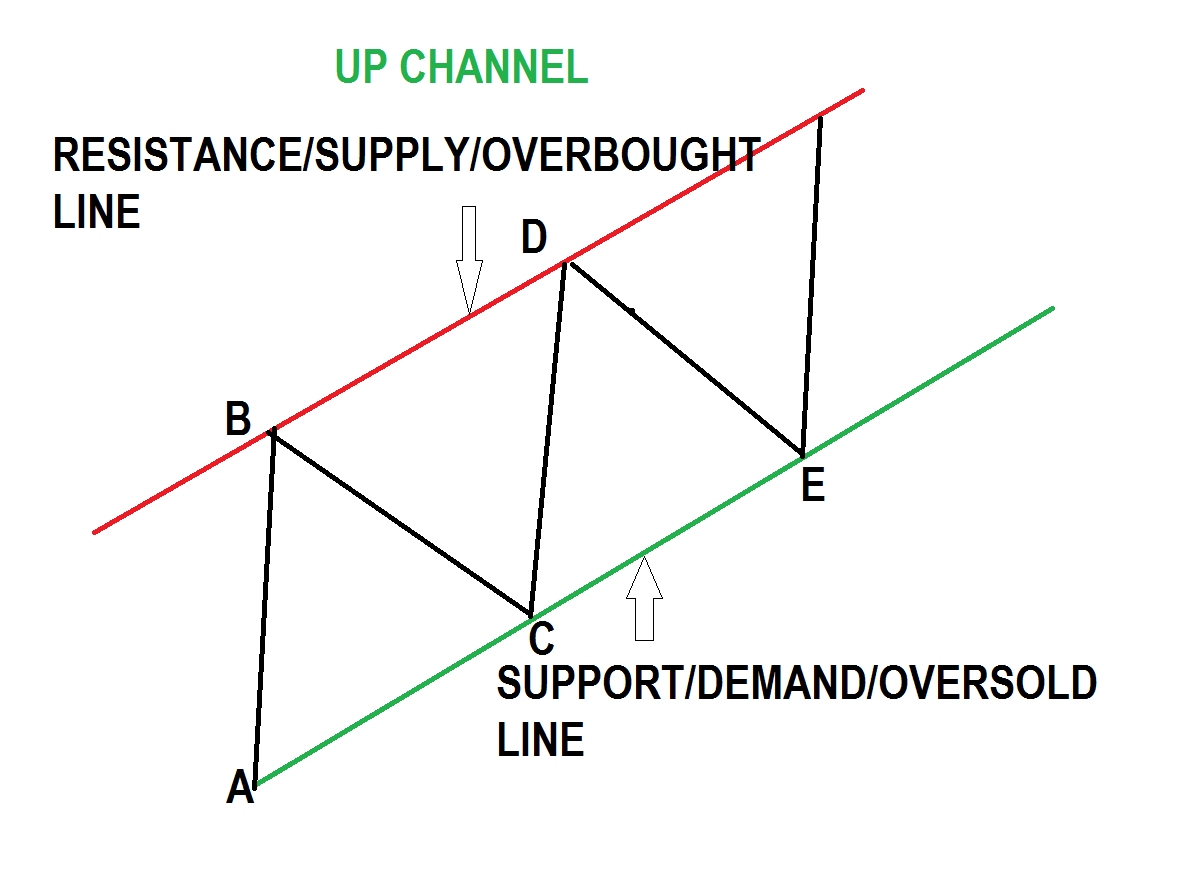

Trendlines measure the price move of a forex pair when the price is increasing or decreasing. Trendlines are a visual representation of support and resistance in any time frame. Table of contents.

Is trendline good for trading? Knowing how to use trendlines can be the difference between winning and losing trades. The analyst made this known while sharing an ultra bullish prediction on social media platform x.

Trendlines are used to determine whether an asset is in a form of uptrend or downtrend. Apart from the patterns created by the price movement, the two key tools you need for analyzing price action are the trendlines and support and resistance levels. Whether it's an uptrend or downtrend, these lines act as visual aids on candlestick charts, providing insights into market direction and serving as support or resistance.

Traders wait for the price to break above or below a trend line, indicating a potential trend reversal or continuation. They are probably one of the most underutilized ones as well. Trend line trading offers several effective strategies that traders can utilize.

The trend line breakout strategy. The support zone can be used to build a trade around, regardless of how the price evolves; Basically, a trend line is a line drawn between two price points that’s used to verify a trend in the price of an asset.

Trendlines that are applied to an uptrend are often called “rising trendline”, while trendlines that represent downtrends are also called “falling trendlines.” Trendline analysis in forex is a crucial price action method that helps us first and foremost in trend detection. If drawn correctly, they can be as accurate as any other method.